How to Increase CIBIL Score from 650 to 750 (Step-by-Step)

What is a CIBIL Score?

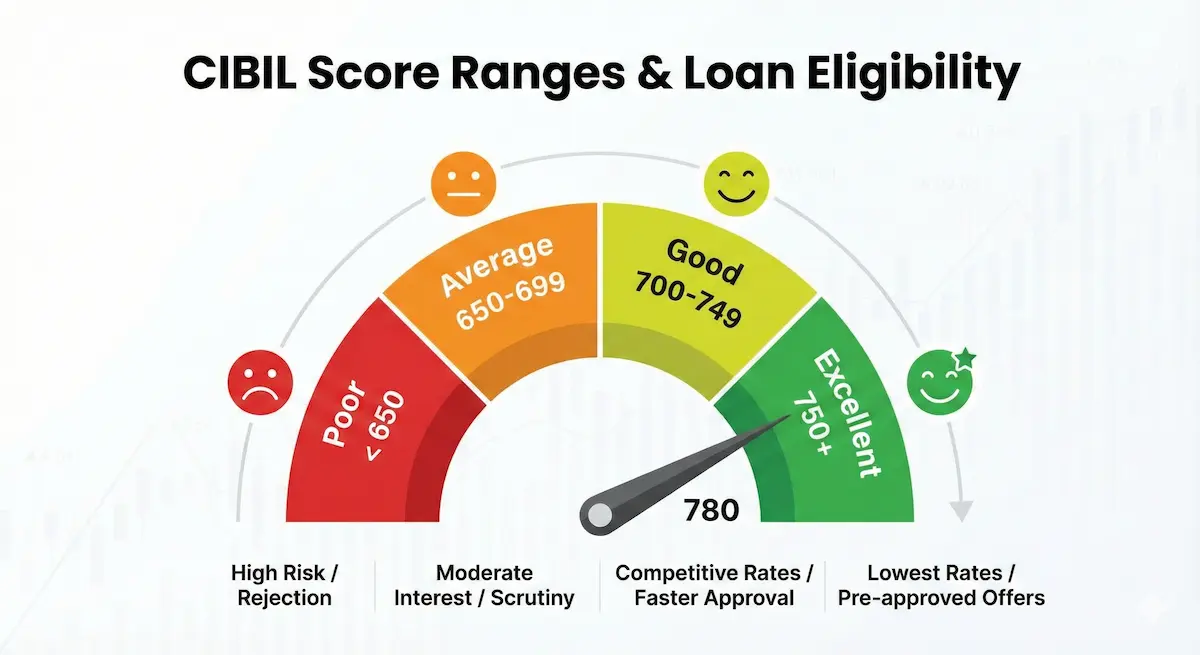

A CIBIL score is a 3-digit number (300-900) summarizing your credit history. A score of 750+ is considered excellent and unlocks lower interest rates on loans.

Here is the code to replace that placeholder. I have wrapped the image in a styled container with a caption area to keep it looking professional. Option 1: Standard Image Component (If you have the file) Use this if you have generated the image (using the prompts I gave you) and saved it to your public folder. TypeScript

| Score Range | Status | Impact |

|---|---|---|

| 750 - 900 | Excellent | Lowest Rates, Instant Approval |

| 700 - 749 | Good | Strong Approval Chances |

| 650 - 699 | Fair | Higher Rates, Stricter Terms |

| Below 650 | Poor | High Rejection Risk |

The "Settled" vs "Closed" Status Trap

One of the most damaging mistakes is accepting a "One-Time Settlement" (OTS) from a bank. It might save you money now, but it costs you your credit reputation for years.

Situation: You owe ₹2 Lakhs but can't pay. Bank offers to close loan for ₹1.5 Lakhs.

- Bank Marks: "Settled"

- Impact: Score drops by 75-100 points.

- Duration: Stays on report for 7 years.

Action: Contact the bank, pay the remaining difference (e.g., ₹50,000).

- Request: Ask for a "No Objection Certificate" (NOC).

- Update: Ensure they change status to "Closed".

- Result: Score bounces back within 30-45 days.

Raising a CIBIL Dispute: Step-by-Step

If you find errors (wrong name, closed loan showing active, identity theft), you must dispute it immediately directly on the CIBIL website.

- Login: Go to cibil.com and access your free credit report.

- Identify: Locate the specific account or personal detail that is incorrect.

- Dispute: Click on the "Raise a Dispute" button in the Dispute Center section.

- Evidence: Upload supporting proofs like NOC, payment receipts, or closure letters.

- Resolution: CIBIL contacts the lender for verification. Correction typically takes up to 30 days.

Credit Utilization Hack: The "30% Rule"

The Secret Hack: Pay BEFORE Statement Date

Banks report your balance to CIBIL on the Statement Generation Date, not the Payment Due Date.

You spend ₹90k (Limit ₹1L). Statement generates showing ₹90k due. CIBIL sees 90% utilization (Bad).

Pay ₹85k 2 days *before* statement date. Statement generates showing ₹5k due. CIBIL sees 5% utilization (Excellent).

Secured Credit Cards: Rebuilding from Scratch

If your score is too low (<650), no bank will give you a regular loan. The solution is a Secured Credit Card backed by a Fixed Deposit (FD).

| Bank / Card | Min FD Amount | Features |

|---|---|---|

| IDFC WOW | ₹2,000 | No Income Proof, Lifetime Free |

| OneCard (Metal) | ₹5,000 | Mobile-first app, Metal Card |

| Kotak 811 | ₹10,000 | Low Barrier Entry for existing customers |

12-Month Step-by-Step Action Plan

Financial Impact: Why 750+ Matters

Why bother repairing your score? Because a good score saves you lakhs on big loans.

| CIBIL Score | Interest Rate | Total Interest Paid |

|---|---|---|

| 650 (Fair) | 10.0% | ₹65.8 Lakhs |

| 750 (Excellent) | 8.5% | ₹54.1 Lakhs |

| Savings | - | ₹11.7 Lakhs Saved! |

Frequently Asked Questions (FAQs)

Final Verdict

Improving your CIBIL score is a journey of discipline, not a quick fix. Be wary of agencies promising overnight miracles.

Fincado Research Team

Fact CheckedOur analysis is built on deep-dive research into RBI Benchmarks and lender-specific disclosures. We verify every interest rate and fee structure against real-world borrower approvals to ensure the highest level of accuracy for Indian home buyers.

Disclaimer: This guide is for educational purposes. We do not provide credit repair services. Always deal directly with CIBIL or your lender for disputes. Beware of agencies promising instant score hikes.

Check Your Financial Health

Use our free tools to estimate your credit score and plan your loans.