EMI Calculator Guide 2025-26: Formulas & Tax Benefits

EMI (Equated Monthly Installment) is the fixed monthly payment you make to repay a loan, combining both principal and interest components. The Reserve Bank of India (RBI) regulates lending practices to ensure transparent EMI structures across banks and NBFCs.

Key Components

- Principal: Original loan amount.

- Interest Rate: Annual percentage charged.

- Tenure: Repayment period.

- Fees: Processing charges (0.5% - 2%).

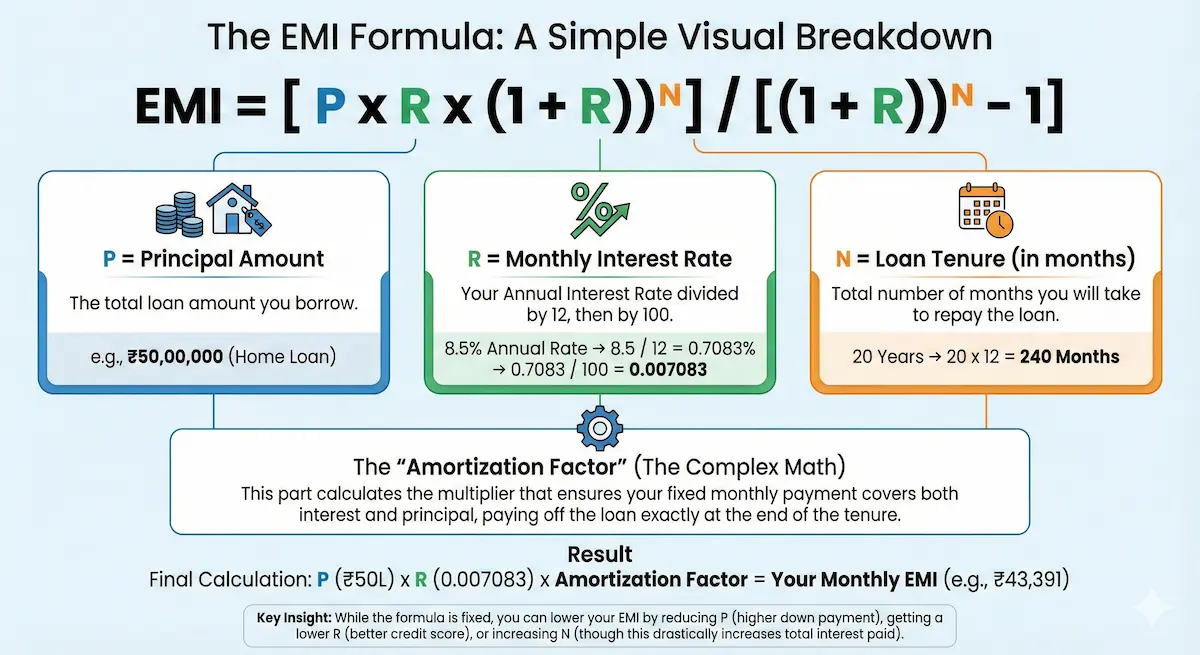

EMI Formula Explained

The standard EMI calculation formula used by Indian lenders is:

- P = Principal loan amount (₹)

- R = Monthly interest rate = Annual rate ÷ (12 × 100)

- N = Loan tenure in months

Loan Details: ₹40,00,000 @ 8.5% for 20 years (240 months)

Monthly rate R = 8.5 ÷ (12 × 100) ≈ 0.00708

Using the formula, the monthly EMI comes to approximately ₹34,699.

Calculations by Loan Type

1. Home Loan EMI

Home loans typically have the longest tenure (15–30 years) and relatively lower interest rates (around 8.5%–9.5% in 2025).

| Loan Amount | Rate | Tenure | EMI | Total Interest |

|---|---|---|---|---|

| ₹50 lakh | 8.5% | 20 yrs | ₹43,391 | ₹54.14 lakh |

| ₹50 lakh | 9.0% | 20 yrs | ₹44,986 | ₹57.97 lakh |

| ₹50 lakh | 8.5% | 30 yrs | ₹38,448 | ₹88.41 lakh |

Key Insight: A 0.5% rate increase adds about ₹3.83 lakh to your total interest over 20 years.

2. Personal Loan EMI

Personal loans carry higher rates (roughly 10.5%–24%) with shorter tenures of 1–5 years.

| Loan Amount | Rate | Tenure | EMI | Total Interest |

|---|---|---|---|---|

| ₹5 lakh | 12% | 3 yrs | ₹16,607 | ₹97,852 |

| ₹5 lakh | 18% | 3 yrs | ₹18,076 | ₹1,50,736 |

3. Car Loan EMI

Auto loans usually range around 8.5%–12% with tenures of 3–7 years.

| Loan Amount | Rate | Tenure | EMI | Total Interest |

|---|---|---|---|---|

| ₹8 lakh | 9.5% | 5 yrs | ₹16,744 | ₹2,04,640 |

| ₹8 lakh | 9.5% | 7 yrs | ₹12,756 | ₹2,71,504 |

Pro Tip: Shorter tenure saves about ₹66,864 in interest, but increases monthly EMI by roughly ₹3,988.

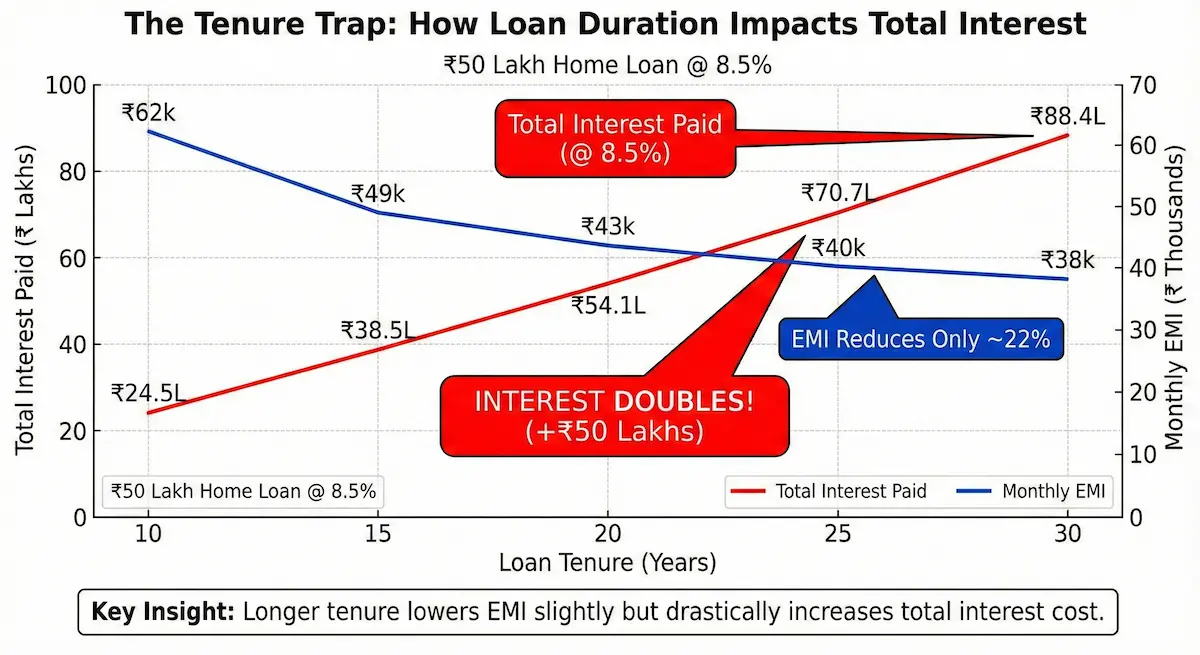

EMI vs Tenure Impact

For a ₹50 lakh home loan at 8.5%, the choice of tenure dramatically changes your interest outgo.

| Tenure | Monthly EMI | Total Interest | Interest vs Principal |

|---|---|---|---|

| 10 years | ₹62,137 | ₹24.56 lakh | 49% |

| 15 years | ₹49,147 | ₹38.46 lakh | 77% |

| 20 years | ₹43,391 | ₹54.14 lakh | 108% |

| 30 years | ₹38,448 | ₹88.41 lakh | 177% |

Doubling tenure from 15 to 30 years:

- Reduces EMI by only about 22%

- But increases total interest by roughly 130% (around ₹49.95 lakh extra)

Decision Framework: Choose longer tenure if cash flow is tight and you plan to prepay later. Choose shorter tenure if your income is stable and you want to minimise interest paid.

Interest Rate Sensitivity

Small changes in interest rates have a large impact over long tenures, especially on home loans.

| Interest Rate | Monthly EMI | Total Interest | Difference (from 8.5%) |

|---|---|---|---|

| 7.5% | ₹40,280 | ₹46.67 lakh | Save ₹7.47 lakh |

| 8.0% | ₹41,822 | ₹50.37 lakh | Save ₹3.77 lakh |

| 8.5% (Base) | ₹43,391 | ₹54.14 lakh | - |

| 9.0% | ₹44,986 | ₹57.97 lakh | Pay ₹3.83 lakh more |

| 9.5% | ₹46,605 | ₹61.85 lakh | Pay ₹7.71 lakh more |

| 10.0% | ₹48,251 | ₹65.80 lakh | Pay ₹11.66 lakh more |

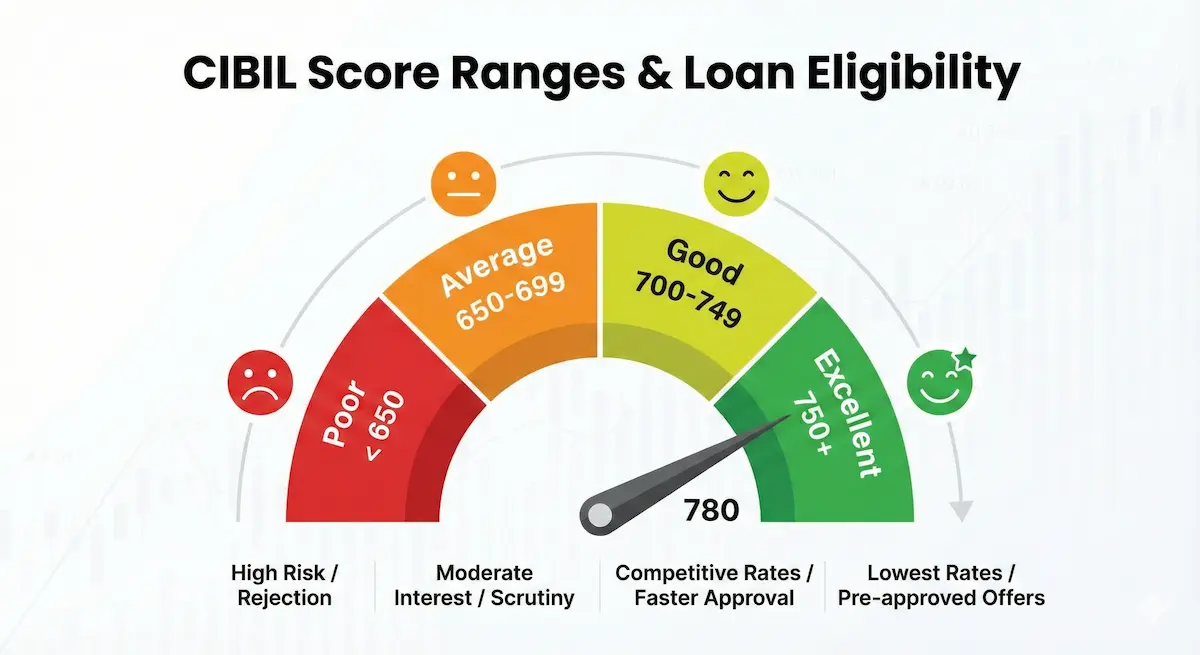

Rate Negotiation Tips

- Compare at least 4–5 lenders; rates can differ by 0.5%–1%.

- Use a strong credit score (typically 750+) as leverage.

- Track RBI repo trends to time fixed-rate and balance transfer decisions.

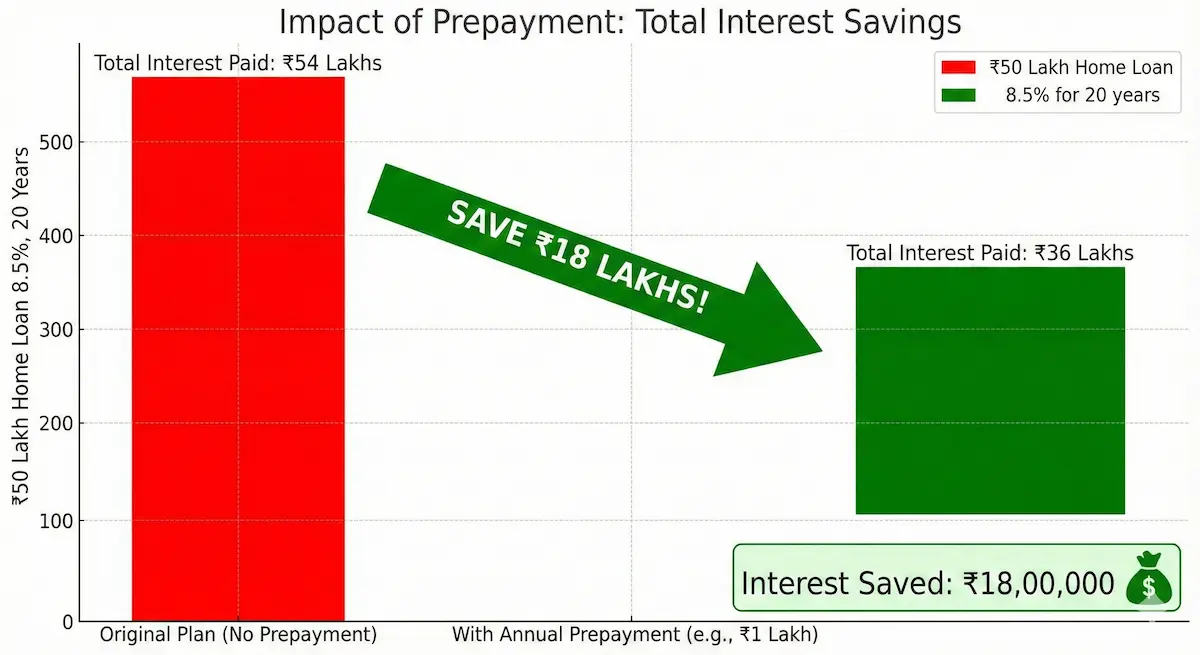

How Prepayment Reduces EMI & Interest

Example Scenario: ₹40 Lakh, 20-Year Home Loan @ 8.5%

By paying just one extra lakh per year (or ~₹8,300/month extra):

- Interest Saved: ₹16,32,142

- Tenure Reduced: From 20 to about 11 years

- Savings: ~40% of interest

Increase your EMI by 10% every year as your income grows:

- Year 1–2: ₹34,699

- Year 3–4: ₹38,169

- Result: Clear loan in around 12–13 years

- Save ₹18+ lakh in interest

EMI Myths Busted

EMI Impact on Credit Score

| Action | Impact on Score | Timeline |

|---|---|---|

| On-time EMI payments | +10–30 points/year | 12+ months |

| 1–30 days late | −50 to −100 points | Immediate |

| 31–60 days late | −100 to −150 points | Immediate |

| 60+ days late | −150+ points | Immediate + stays up to 7 years |

| Loan settlement | Similar to default | Stays up to 7 years |

| Full prepayment | Neutral to positive | Immediate |

Maintaining a strong CIBIL score is crucial for securing lower EMI rates and faster approvals.

EMI-to-Income Ratio

Formula: (Total EMIs ÷ Monthly Income) × 100

- Ideal zone: Below ~40%

- Risky zone: Above ~50%

When EMI is Rejected

If your loan application was denied, it is likely due to one of these common red flags.

Lenders see low scores as high risk.

Existing EMIs consume >50% income.

Missing ITRs, slips, or erratic banking.

<1 year in current job or frequent hops.

Unapproved layouts or unclear titles.

Missing KYC, signatures, or old proofs.

- Reduce loan amount by 20–30%

- Add a co-applicant (Spouse/Parent)

- Apply after 12 on-time EMI payments

- Try NBFCs (Lenient criteria but higher rates)

Expert Planning Tips 2025

- 1The 40-30-20 Rule: Keep home loan EMI within 40% of monthly income. Aim for all EMIs combined to stay near 30–40%. Reserve at least 20% for savings/investments.

- 2Timing Matters: Look out for New Year and festive-season rate offers and fee waivers. Consider quarter-ends when lenders push to meet disbursement targets.

FAQs

Conclusion: Master Your EMI

Understanding how EMIs are calculated gives you control over your loans. Negotiate rates, prepay early, and protect your credit score.

Fincado Research Team

Fact CheckedOur analysis is built on deep-dive research into RBI Benchmarks and lender-specific disclosures. We verify every interest rate and fee structure against real-world borrower approvals to ensure the highest level of accuracy for Indian home buyers.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Loan terms, interest rates, and RBI regulations may vary by lender and over time. Always consult your bank or financial advisor before making loan decisions.

Ready to calculate your EMI?

Plan your loan smartly and save thousands in interest with Fincado.