Health Insurance Buying Guide: Top 5 Features to Check Before Buying

Choosing the right health insurance plan in India can be confusing, especially with technical terms like room rent capping, no claim bonus, waiting periods, and cashless claims. The primary goal of this health insurance buying guide is to help you quickly understand which features matter most before paying your first premium.

This article explains the top 5 features to check before buying health insurance in simple language, with a special focus on Indian policies. By the end, you will know how to compare policies smartly, avoid hidden costs, and pick a mediclaim plan that actually works at the time of hospitalization.

What is a Health Insurance Buying Guide?

A health insurance buying guide is a structured checklist that helps you evaluate and compare health insurance policies before purchase. Instead of choosing a plan only on the basis of premium, this guide focuses on features like room rent limits, no claim bonus (NCB), waiting periods, co-payment, and claim process.

How Does Health Insurance Work in India?

Health insurance is a contract between you and an insurer where you pay a premium every year, and the insurer covers hospitalization expenses.

Top 5 Features to Check

These are the non-negotiable features you must verify before buying any policy.

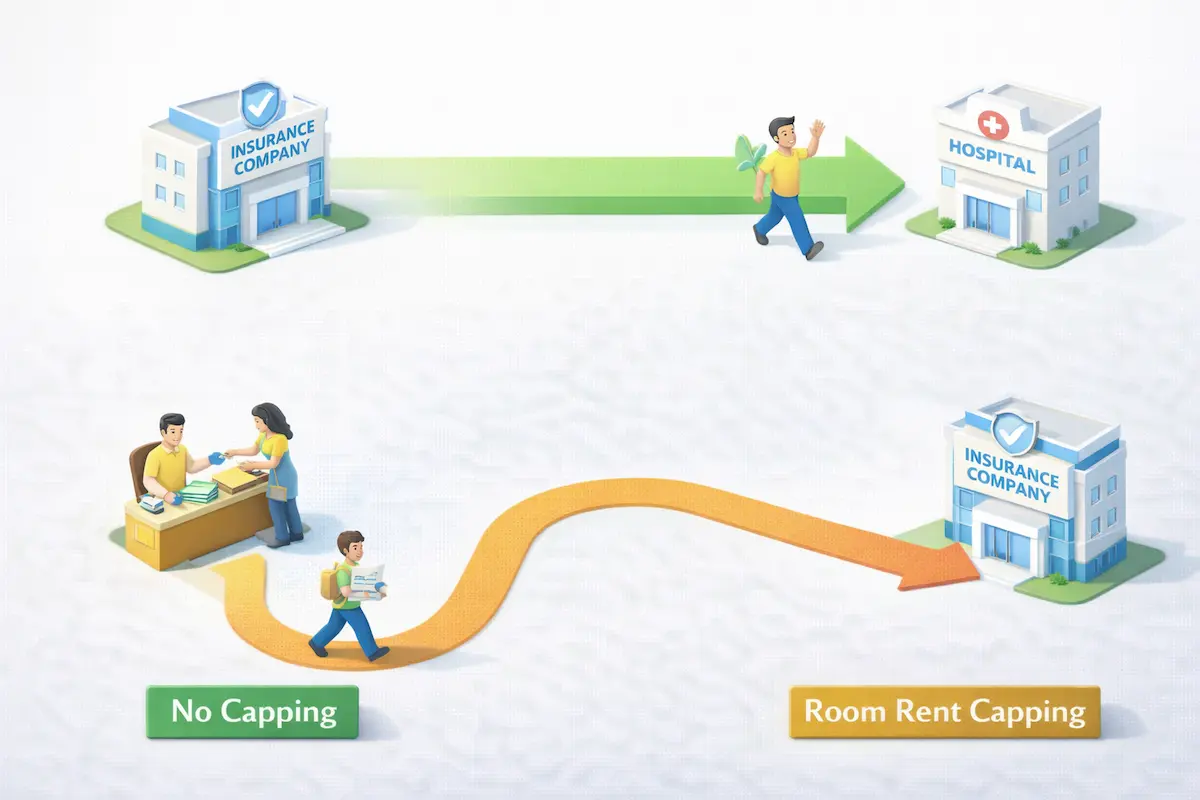

Many policies put a limit like 1% of Sum Insured per day. If your room rent crosses this limit, many hospitals upgrade all related costs (doctor fees, nursing, etc.), forcing you to pay the proportionate difference.

NCB is a reward for not making a claim. Good policies increase your Sum Insured by 10–50% every claim-free year.

- Check Maximum NCB limit (e.g., up to 100% or 150% of base cover).

- Check if NCB reduces partially or fully upon making a claim.

| Condition Type | Typical Waiting Period |

|---|---|

| Pre-existing Diseases (PED) | 2 to 4 Years |

| Specific Illnesses (Hernia, Cataract) | 2 Years |

| Initial Waiting Period | 30 Days |

| Maternity (if covered) | 9 to 24 Months |

Tip: If you have parents with health issues, look for plans with shorter waiting periods (e.g., 2 years instead of 4).

Cashless: Insurer pays hospital directly. Reimbursement: You pay first, claim later. Always check the Network Hospital List.

- Co-payment: Avoid policies that force you to pay 10-20% of every bill.

- Restoration Benefit: Does the Sum Insured refill if you exhaust it?

- Daycare Procedures: Coverage for surgeries not requiring 24-hour hospitalization.

Eligibility & Tax Benefits

- Entry Age: Usually 18 to 65 years.

- Lifelong Renewability: Ensure the policy allows you to renew for life.

- Ideal Cover: ₹10–25 Lakh for metro families.

Check your total tax savings on our Income Tax Calculator.

| Category | Limit |

|---|---|

| Self & Family (<60) | ₹25,000 |

| Parents (Senior Citizens) | ₹50,000 |

| Max Combined | ₹75k - ₹1L |

Risks & Alternatives

| Aspect | Personal Policy | Employer Cover | Emergency Fund |

|---|---|---|---|

| Coverage | High (Chosen) | Low (Fixed) | Limited |

| Validity | Lifelong | Ends with Job | Always |

| Best Use | Long-term Safety | Temporary Support | Small Expenses (Park in FD) |

- Hidden Sub-limits: Check for caps on specific treatments like Cataract.

- Portability: Port while you are healthy.

- Claim Ratio: Check CSR and Incurred Claim Ratio.

Frequently Asked Questions (FAQs)

Final Verdict

A smart health insurance purchase is not about chasing the lowest premium, but about the right features. Avoid strict room rent caps, ensure a healthy No Claim Bonus, and verify waiting periods.

Fincado Research Team

Fact CheckedOur analysis is built on deep-dive research into RBI Benchmarks and lender-specific disclosures. We verify every interest rate and fee structure against real-world borrower approvals to ensure the highest level of accuracy for Indian home buyers.

Disclaimer: Insurance is a subject matter of solicitation. The information provided in this article is for educational purposes only. Please read the policy wordings and terms & conditions carefully before concluding a sale. Fincado is not an insurance aggregator or broker.