Home Loan Guide 2025-26: Eligibility & Tax Benefits

A home loan (also called housing loan or mortgage) is a secured loan provided by banks and housing finance companies (HFCs) to help you purchase, construct, renovate, or extend residential property in India. The property itself serves as collateral, which is why home loans offer lower interest rates (8.5%-9.5% in 2025) compared to personal loans.

Types:

- Home Purchase Loan

- Home Construction Loan

- Home Improvement Loan

- Balance Transfer Loan

Key Features

- LTV: Up to 90%

- Rate: 8.50% - 9.50%

- Tenure: 5 - 30 Years

- Tax: Save up to ₹3.5L

Home Loan Eligibility (2025)

Understanding eligibility is the first step toward successful loan approval. Here is what major Indian lenders evaluate:

1. Age Requirements

| Bank/HFC | Min Age | Max Age (Maturity) |

|---|---|---|

| SBI, HDFC, ICICI | 21 years | 70 years |

| Axis Bank | 21 years | 70 years |

| PNB Housing | 21 years | 75 years |

2. Income & Credit Score

- Min Salary: ₹25k - ₹40k/mo

- Business Income: ₹2L+ Annual

- Work Exp: 2-3 Years Total

- 750+: Excellent (8.5%)

- 700-749: Good (8.75%)

- <650: High Risk

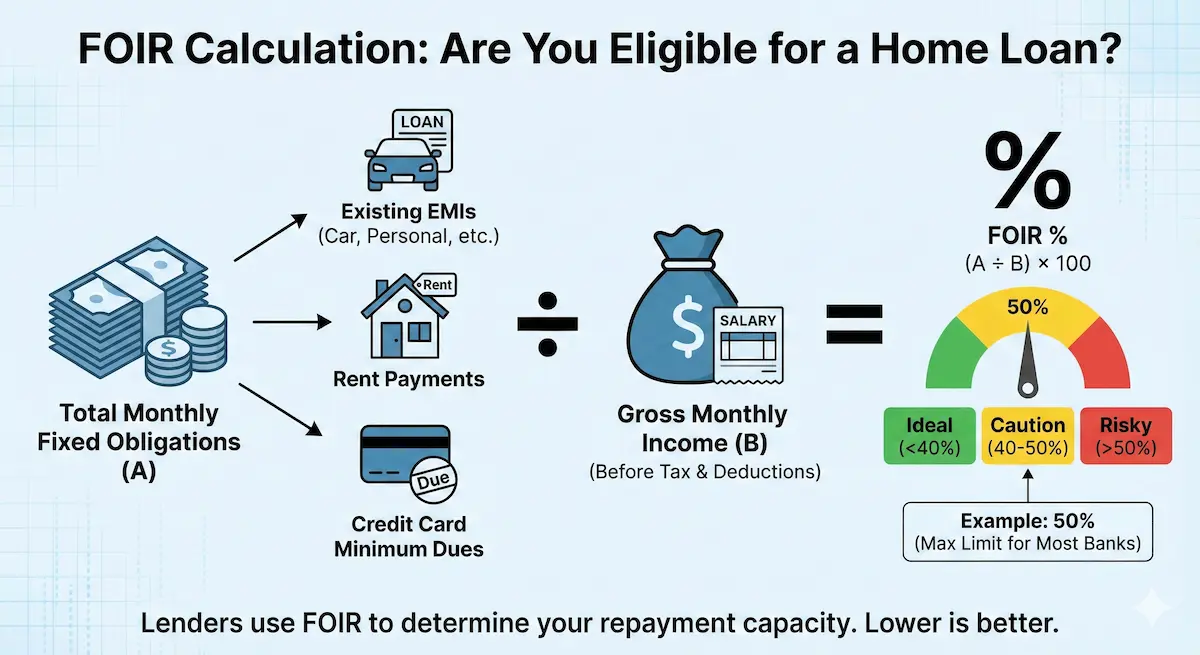

FOIR Explained

| Lender Type | Max FOIR | Your Take-Home |

|---|---|---|

| Most Banks | 50-55% | 45-50% |

| HFCs | 55-60% | 40-45% |

| Govt Banks | 50% | 50% |

Down Payment Rules

Banks finance only 75-90% of property value. You must pay the rest upfront.

| Property Value | Max LTV (Loan) | Your Payment |

|---|---|---|

| Up to ₹30L | 90% | 10% |

| ₹30L - ₹75L | 80% | 20% |

| Above ₹75L | 75% | 25% |

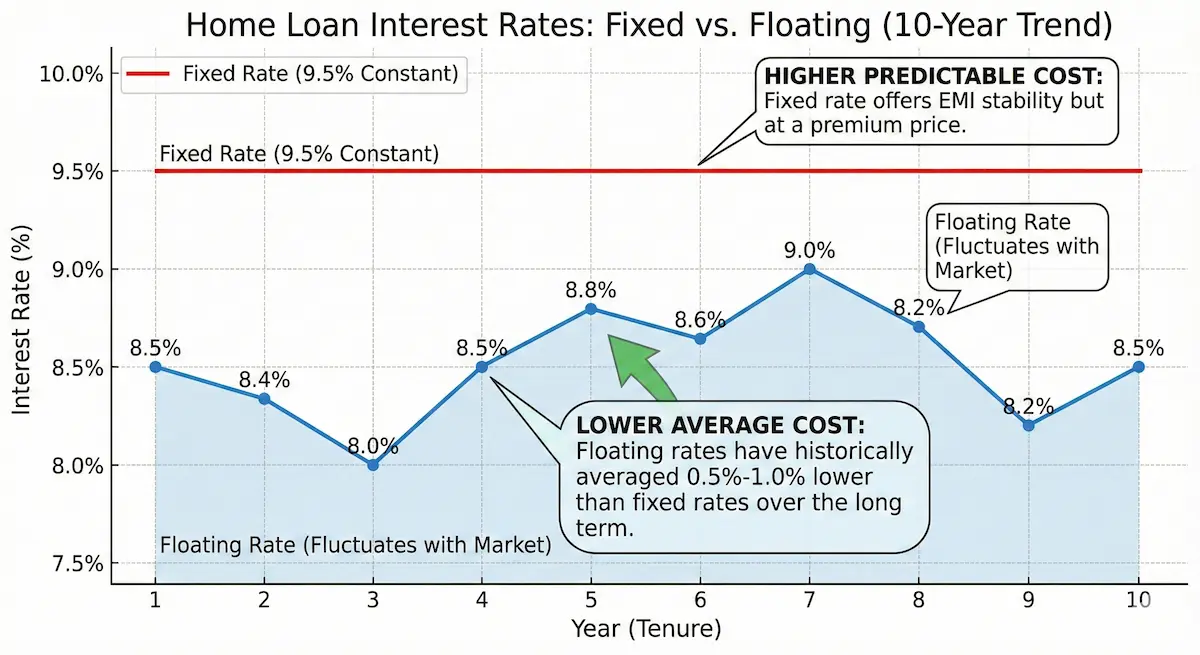

Fixed vs Floating Rates

Changes with RBI Repo Rate.

- ✅ Lower starting rate (8.5%)

- ✅ Zero prepayment charges

- ❌ EMI fluctuates

Constant for 3-5 years.

- ✅ EMI certainty

- ❌ Higher starting rate (9%+)

- ❌ Prepayment penalties apply

Hidden Charges

| Type | Amount | Negotiable? |

|---|---|---|

| Processing Fee | 0.25% - 1% | Yes ✅ |

| Admin Fee | ₹5k - ₹15k | Maybe ⚠️ |

| Legal/Valuation | ₹3k - ₹10k | No ❌ |

Tax Benefits: Save ₹3.5 Lakh

Principal Repayment

- Max ₹1.5 Lakh/year.

- Includes Stamp Duty.

- Lock-in: 5 Years.

Interest Payment

- Max ₹2 Lakh/year (Self-occupied).

- Unlimited (Let-out property).

- Must complete construction in 5 yrs.

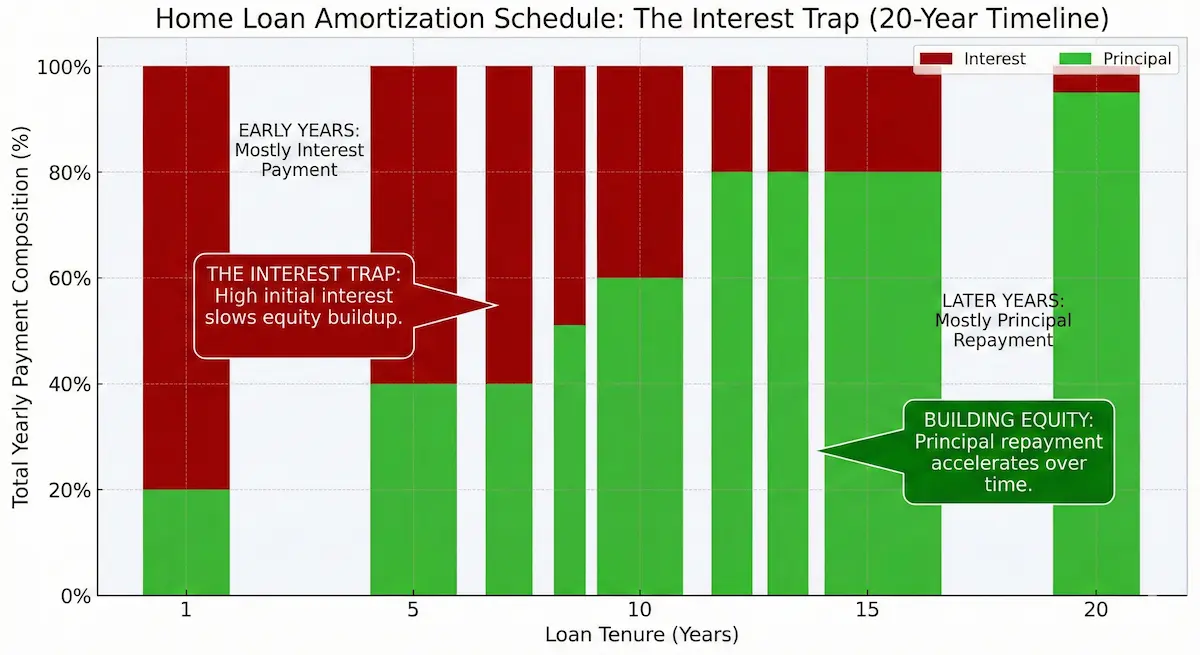

EMI Amortization Reality

First-time buyers are often shocked: Initial EMIs are mostly interest!

| Year | EMI Split |

|---|---|

| Year 1 | 82% Interest / 18% Principal |

| Year 10 | 64% Interest / 36% Principal |

| Year 20 | 1% Interest / 99% Principal |

Common Mistakes

Fix: Follow 30-35% Rule.

Fix: Budget extra 15-20%.

Fix: Check 6mo prior.

Fix: Stick to 15-20 yrs.

Fix: Get 4-5 quotes.

Application Checklist

Phase 1: Pre-Application

- Check Credit Score (Target 750+).

- Calculate Affordability.

- Save Down Payment (20-25%).

Phase 2: Application

- Gather KYC & Income Docs.

- Apply to 3-4 Lenders.

- Property Valuation.

Phase 3: Disbursement

- Sign Agreement & Pay Stamp Duty.

- Buy Insurance.

- Collect Original Deeds (Post-repayment).

Frequently Asked Questions (FAQs)

Final Verdict

With eligibility criteria becoming transparent and tax benefits saving up to ₹3.5 lakh annually, 2025 is an excellent time for first-time buyers.

Fincado Research Team

Fact CheckedOur analysis is built on deep-dive research into RBI Benchmarks and lender-specific disclosures. We verify every interest rate and fee structure against real-world borrower approvals to ensure the highest level of accuracy for Indian home buyers.

Disclaimer: This content is for educational purposes only. Loan terms vary. Always consult your bank or financial advisor.

Buying a home soon?

Use our smart calculator to compare Flat vs Reducing rates and find your true EMI instantly.