The Complete Home Loan Guide 2025: Eligibility, Tax Benefits & Hidden Charges

Buying your first home in India is one of the biggest financial decisions you'll ever make, and choosing the right Home Loan can save you lakhs of rupees over the loan tenure. This comprehensive guide covers everything from CIBIL score requirements and tax benefits to hidden charges, helping you make an informed decision before signing on the dotted line.

Whether you're a first-time home buyer or looking to refinance, understanding home loan eligibility criteria, tax deductions under Section 80C, 24(b), and 80EEA, and the difference between RLLR vs MCLR will put you in control of your home-buying journey.

Secure your dream home with the right loan strategy.

What is a Home Loan?

A home loan (also called housing loan or mortgage) is a secured loan provided by banks and housing finance companies (HFCs) to help you purchase, construct, renovate, or extend residential property.

Key Components

- Principal Amount: Total loan amount borrowed.

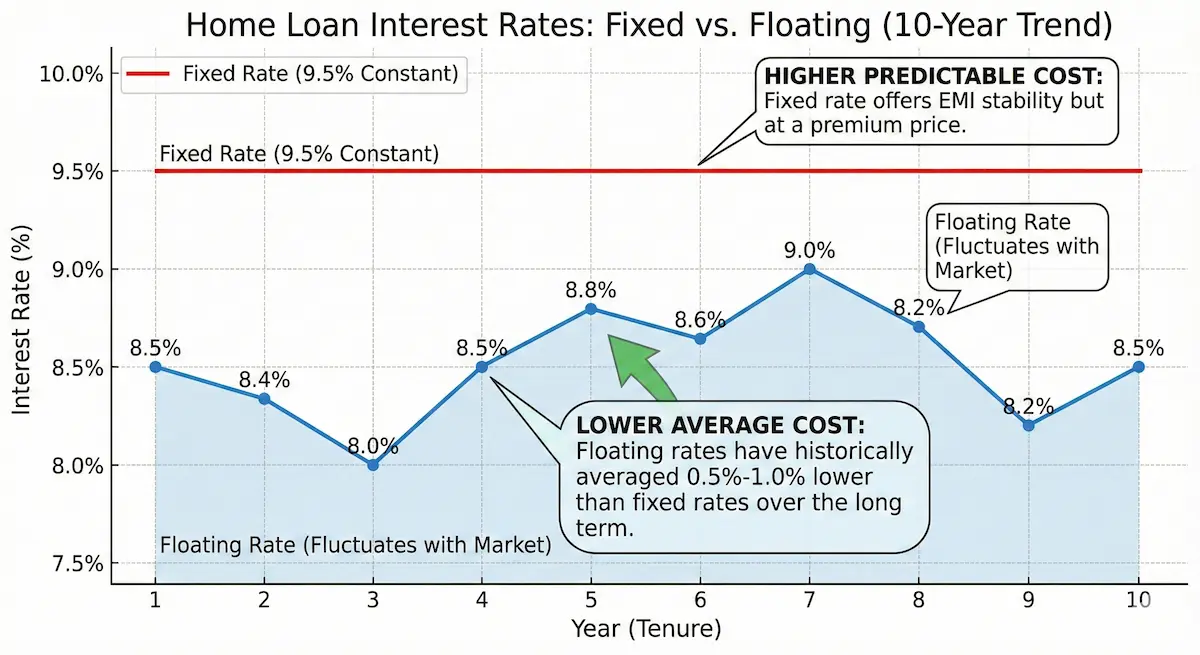

- Interest Rate: Cost of borrowing (fixed or floating).

- Tenure: Repayment period (5 to 30 years).

- EMI: Monthly payment (Principal + Interest).

The Process

- Pre-Approval: Check eligibility & get sanction.

- Property Check: Legal & technical verification.

- Disbursement: Funds released to seller.

- Repayment: Pay EMIs & claim tax benefits.

Eligibility Checklist

Before you apply, make sure you meet these critical eligibility parameters.

| Score Range | Eligibility Status | Interest Rate Impact |

|---|---|---|

| 750+ (Excellent) | Very high chance | Lowest rates |

| 700-749 (Good) | High chances | Standard rates |

| 650-699 (Fair) | Moderate chances | Higher rates |

| Below 650 (Poor) | Low chances | Very high rates |

FOIR is the ratio of your total monthly debt obligations to your gross monthly income. Most lenders prefer a FOIR of 40-50% or lower.

Check Your Eligibility Now

Use our advanced calculator to see exactly how much loan you can afford based on your salary and existing EMIs.

Home Loan EMI CalculatorTax Benefits: The Crucial Section

One of the biggest advantages of taking a home loan in India is the significant tax deductions available under the Income Tax Act, 1961.

| Section | Covers | Max Deduction | Eligibility |

|---|---|---|---|

| Section 80C | Principal Repayment | ₹1,50,000 | All borrowers |

| Section 24(b) | Interest on loan | ₹2,00,000 | Self-occupied property |

| Section 80EEA | Additional Interest | ₹1,50,000 | First-time buyers* |

*Note: Section 80EEA applies to loans sanctioned between April 1, 2019, and March 31, 2022, for properties with stamp duty value up to ₹45 Lakhs.

Interest Rates: RLLR vs MCLR

Home loan interest rates in India are benchmarked to either MCLR or RLLR. Most experts now favor RLLR (Repo Linked Lending Rate) because it is directly linked to the RBI's repo rate, offering faster transmission of rate cuts and greater transparency.

Current Home Loan Rates (Live)

| Lender Category | Interest Rate (p.a.) | Processing Fee |

|---|---|---|

| Public Sector Banks | 8.35% — 9.50% | Low (Max ₹10k) |

| Private Sector Banks | 8.75% — 10.50% | Medium (0.5% - 1%) |

| HFCs (Housing Finance) | 9.00% — 11.50% | Medium (0.5% - 2%) |

Hidden Charges List

While the interest rate gets the attention, these charges can increase your cost:

| Charge Type | Typical Amount | Negotiable? |

|---|---|---|

| Processing Fees | 0.25% - 1% of loan | ✅ Yes |

| MODT Charges | ₹2,000 - ₹10,000 | ❌ No |

| Technical Fee | ₹2,000 - ₹5,000 | Sometimes |

| Prepayment Penalty | Zero | N/A |

Home Loan vs Renting

Final Verdict

Buying a home in India is a strategic financial decision. To make the smartest choice:

- Aim for a CIBIL score of 750+ before applying.

- Understand your FOIR and don't over-leverage.

- Maximize tax benefits under Sections 80C and 24(b).

- Choose RLLR-linked floating rate loans for better transparency.

Whether you're a first-time buyer or upgrading, this guide equips you with the knowledge to save lakhs over your loan tenure.

Frequently Asked Questions

Fincado Research Team

Fact CheckedOur analysis is built on deep-dive research into RBI Benchmarks and lender-specific disclosures. We verify every interest rate and fee structure against real-world borrower approvals to ensure the highest level of accuracy for Indian home buyers.

Disclaimer: The information provided in this guide is for educational purposes only. Interest rates, tax laws (Section 80C, 24b), and bank policies change frequently. Please consult a qualified financial advisor or CA before making any final borrowing decisions.

Ready to calculate your home loan eligibility?

Use our free Home Loan EMI Calculator to plan your purchase and discover how much you can afford!