Credit Score Guide 2025-26: How CIBIL Works in India

A credit score is a three-digit number (300-900) that represents your creditworthiness and financial discipline. Think of it as your financial report card that lenders (banks, NBFCs, credit card companies) check before approving any loan or credit card application.

Why It Matters

- Loan Approval: 750+ score = 90% approval rate.

- Interest Rate: Save ₹3-8 lakh on loans.

- Credit Card Limit: Higher limits for better scores.

- Pre-Approved Offers: Instant loans for 750+.

Real-World Impact Example

| Factor | Rohan (CIBIL 810) | Amit (CIBIL 650) |

|---|---|---|

| Loan Approved? | Yes, instantly | Yes, with delays |

| Interest Rate | 8.50% | 10.50% |

| Processing Fee | Waived | ₹30,000 |

| Total Interest | ₹32.48 lakh | ₹42.60 lakh |

| Extra Cost | - | ₹10.42 lakh more! |

CIBIL vs Others: Understanding Bureaus

India has four RBI-licensed Credit Information Companies (CICs). While CIBIL is the most popular, understanding all four helps.

| Feature | CIBIL | Experian | Equifax |

|---|---|---|---|

| Score Range | 300-900 | 300-900 | 300-900 |

| Market Share | 90% | 6% | 3% |

| Used By | Major Banks | Fintechs | Credit Cards |

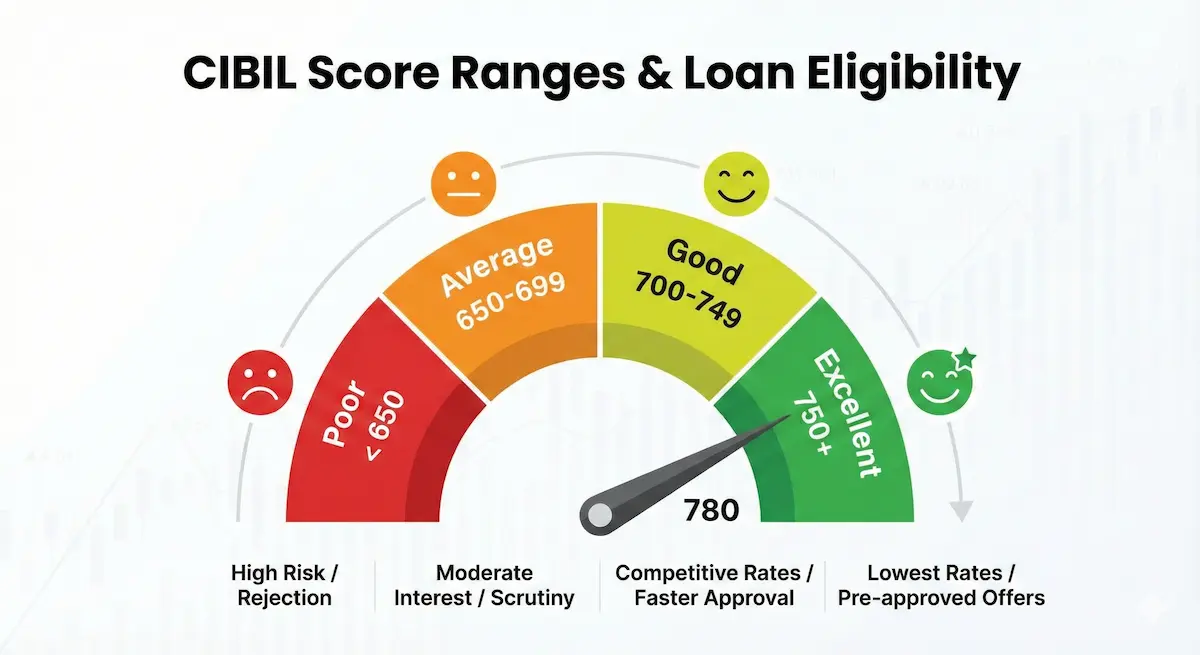

Credit Score Range Explained

| Range | Rating | Approval Rate |

|---|---|---|

| 300-549 | Poor | 5-10% |

| 550-649 | Average | 30-40% |

| 650-699 | Fair | 50-60% |

| 700-749 | Good | 75-85% |

| 750-799 | Very Good | 90-95% |

| 800-900 | Excellent | 95-99% |

Factors Affecting Credit Score

| Factor | Weightage | What It Measures |

|---|---|---|

| Payment History | 35% | On-time EMI/card payments |

| Credit Utilization | 30% | % of credit limit used |

| History Length | 15% | Age of oldest account |

| Credit Mix | 10% | Secured vs Unsecured mix |

| Inquiries | 10% | Hard inquiries in last 6-12 months |

The Payment History Trap (35%)

- 1-30 days late: -50 to -80 points (Stays 3 yrs)

- 31-60 days late: -80 to -120 points (Stays 3 yrs)

- 90+ days late: -150 to -200 points (Stays 7 yrs)

EMI Payment Impact

Since payment history accounts for 35%, consistency is key.

| Duration | Improvement | Effect |

|---|---|---|

| 3 months | +10 to +20 | Establishes pattern |

| 6 months | +25 to +40 | Builds trust |

| 12 months | +50 to +80 | Strong positive signal |

The 30% Utilization Rule

Maintain credit utilization BELOW 30% always.

| Utilization | Impact | Perception |

|---|---|---|

| 0-10% | +10 to +20 | Excellent |

| 11-30% | +5 to +10 | Good |

| 31-50% | Neutral | Acceptable |

| 51-70% | -20 to -40 | Risky |

| 71-90% | -50 to -80 | High Risk |

- Pay Early: Pay before statement generation date.

- Increase Limit: Ask bank to hike limit (lowers ratio).

- Split Expense: Use multiple cards for big buys.

Improvement Timelines

| Start | Target | Time | Required Action |

|---|---|---|---|

| 300-500 | 650 | 24-36 mo | Settle all defaults |

| 550-600 | 700 | 12-18 mo | Clear dues, on-time pay |

| 650-680 | 750 | 6-12 mo | Reduce utilization |

| 700-730 | 780 | 3-6 mo | Optimize utilization |

Myths Debunked

Step-by-Step Fix Strategy

- Download reports from all bureaus.

- Review all entries for errors.

- File disputes for incorrect data.

- Set auto-debit for EMIs.

- Pay cards in full.

- Reduce utilization below 30%.

- Freeze new applications.

- Zero late payments.

- Snowball debt repayment.

- Optimize credit mix.

Frequently Asked Questions (FAQs)

Conclusion

Improving your CIBIL score is about discipline. A score of 750+ will save you lakhs in interest.

Disclaimer: This content is for educational purposes only and does not constitute financial advice.

Ready to improve your finances?

Use our smart calculators to plan your loan repayments.