Inflation Guide: Impact & Wealth Protection Strategies

Inflation quietly erodes your purchasing power every single day, turning today's comfortable savings into tomorrow's financial struggle. Understanding inflation and learning how to combat it isn't just smart financial planning—it's essential for preserving your wealth and achieving long-term financial security.

What is Inflation? The Silent Wealth Destroyer

Inflation represents the rate at which the general price level of goods and services increases over time, causing your money to lose purchasing power. When inflation rises, each rupee in your pocket buys fewer goods and services than it did before.

The Consumer Price Index (CPI) serves as the primary measure of inflation in India. The Reserve Bank of India (RBI) targets an inflation rate of 4% with a tolerance band of 2-6%.

- Today: Basket costs ₹1,000.

- Next Year (6% Inflation): Same basket costs ₹1,060.

- In 10 Years: Same basket costs ₹1,791.

Inflation operates continuously and compounds over time, persistently diminishing your wealth's real value.

Real Return vs Nominal Return

Many investors make the fatal mistake of evaluating investments based solely on nominal returns without accounting for inflation.

Example: ₹1L invested at 6% becomes ₹1.06L. Nominal Return = 6%.

Formula: (1 + Nominal) ÷ (1 + Inflation) − 1

Inflation in India: Historical Trends

| Year | Status | Details |

|---|---|---|

| 2025 | Declining | Averaged ~2.5% (Record low 0.25% in Oct) |

| 2024 | Moderate | Annual average 4.9% |

| 2023 | High | Averaged 5.7%, peak 7.4% |

| 2022 | Elevated | Averaged 6.7% |

Historical Context: India saw 12.17% inflation in 2013. The long-term average (2012-2025) is approx 5.68%.

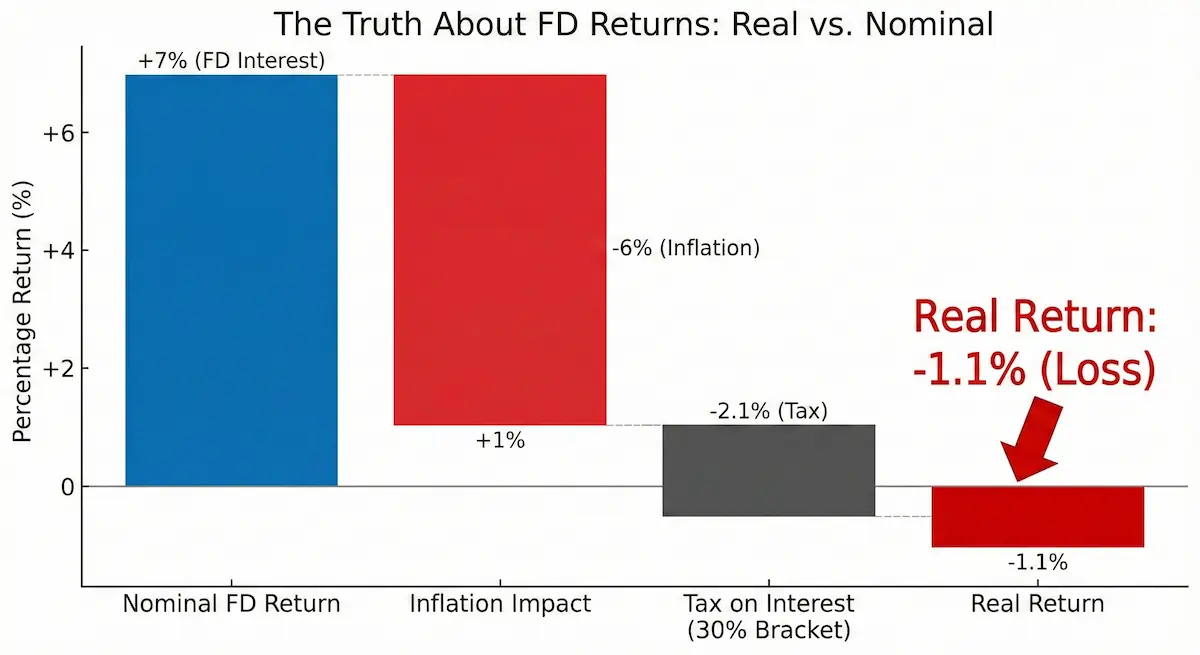

The FD-Inflation Trap

When FD rates fail to exceed inflation, you experience negative real returns. Tax makes it worse.

| Nominal FD Interest | 6.0% |

| Tax (30% slab) | -1.8% |

| Post-Tax Return | 4.2% |

| Inflation | 5.0% |

| Real Return | -0.8% (Negative!) |

Long-Term Impact (25 Years):

- FD CAGR: 7.28% | Inflation CAGR: 5.55%

- Real Return (Pre-tax): Only 1.63%

- Post-tax: Likely negative real growth.

How to Beat Inflation

Shift from "safe" investments to growth-oriented assets.

25-Year Real Return: ~12.4%

Companies raise prices with inflation, growing revenues and stock prices. Best for long-term goals.

25-Year Real Return: ~4.5%

Traditional hedge. Provides portfolio stability during volatility. Match or beat inflation.

Hedge: High

Property values and rents rise with inflation. REITs offer easier access than physical property.

Inflation-Adjusted Planning

If you ignore inflation, you will under-save for retirement.

Retirement Corpus Example

You need a corpus that generates ₹1.6 Lakhs monthly, not ₹50k. The gap is massive.

Your Inflation-Protection Checklist

- Calculate real returns on all current investments.

- Shift allocation to Equity (Index Funds/MFs) for long term.

- Increase SIPs annually to match inflation/income growth.

- Use inflation-adjusted calculators for all financial goals.

Final Verdict

Inflation is dangerous, but defeat is optional. By shifting from FDs to Equity and Gold, and planning with real returns in mind, you can protect your purchasing power.

Disclaimer: This content is for educational purposes only. Past inflation trends do not guarantee future rates. Investment in securities market are subject to market risks.

See Your Future Cost of Living

Use our Inflation Calculator to see exactly how much your lifestyle will cost in 10, 20, or 30 years.