Personal Loan Rates India 2025-26: Comparison Guide

A personal loan is an unsecured loan provided by banks and NBFCs for any personal use—medical emergencies, weddings, vacations, debt consolidation, or business needs—without requiring collateral or security.

Key Characteristics (2025)

- Interest Rates: 10.5% - 24% p.a.

- Tenure: 1 to 5 years (12-60 months).

- Processing: 24-72 hours (Instant available).

- Collateral: None required (Unsecured).

Current Interest Rates (2025)

Interest rates vary significantly based on lender type. Here is the landscape for March 2025.

Top Banks

| Bank | Rate Range | Processing Fee |

|---|---|---|

| SBI | 11.15% - 15.00% | 1.5% |

| HDFC Bank | 10.50% - 24.00% | Up to 2.5% |

| ICICI Bank | 10.75% - 19.00% | Up to 2.25% |

| Axis Bank | 10.99% - 21.00% | Up to 2% |

Top NBFCs

| NBFC | Rate Range | Processing Fee |

|---|---|---|

| Bajaj Finserv | 11.00% - 28.00% | Up to 3.93% |

| Tata Capital | 10.99% - 27.00% | Up to 2.75% |

| Aditya Birla | 11.50% - 24.00% | Up to 3% |

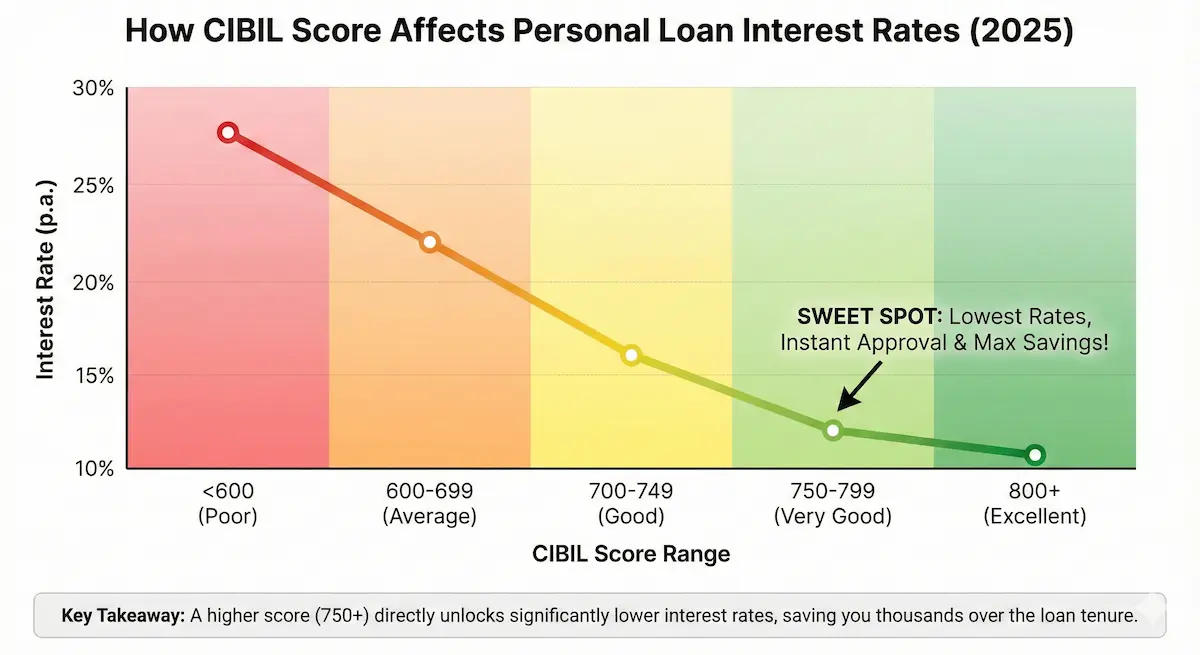

Credit Score Impact

| CIBIL Score | Rate Impact | Approval Chance |

|---|---|---|

| 800-900 | Best (-3% discount) | 95%+ |

| 750-799 | Prime (-2% discount) | 90% |

| 650-699 | Higher (+2-3% premium) | 50% |

| < 600 | Max rates | 10-15% |

Scenario: Borrower with 650 CIBIL vs 800 CIBIL.

Rate Difference: 24% vs 11%.

Salary vs Self-Employed Rates

Self-employed borrowers typically pay 2-4% higher ratesdue to income variability.

| Lender | Salaried Rate | Self-Employed Rate |

|---|---|---|

| PSU Banks | 11.4% - 15.5% | 13.5% - 17.8% |

| Private Banks | 10.5% - 19% | 12.5% - 22% |

| NBFCs | 11% - 24% | 13% - 28% |

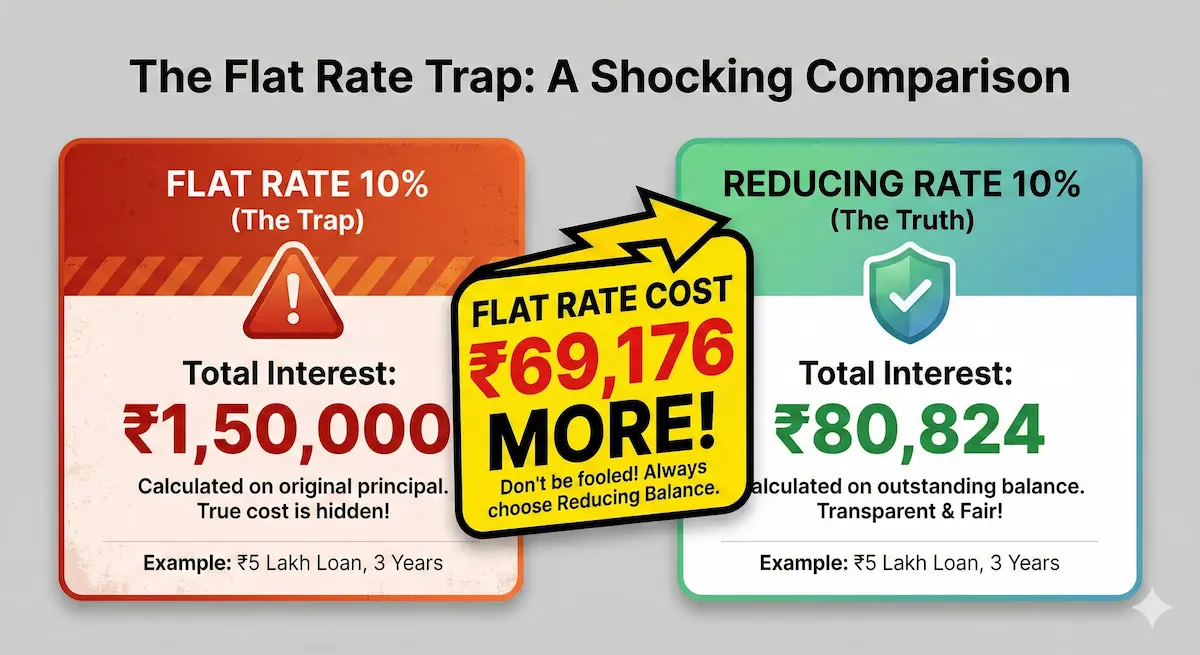

The "Flat Rate" Trap

Dealer: "10% Flat Rate"

You pay interest on the full principal for the entire tenure, even as you repay.

Effective: ~18% Reducing

A 10% Flat Rate is actually equal to an ~18% Reducing Rate. You pay double!

EMI Comparison Table (₹5 Lakh)

| Rate | 1 Year EMI | 3 Years EMI | 5 Years EMI |

|---|---|---|---|

| 11% | ₹43,974 | ₹16,350 | ₹10,867 |

| 14% | ₹44,532 | ₹17,108 | ₹11,654 |

| 17% | ₹45,095 | ₹17,881 | ₹12,472 |

| 20% | ₹45,661 | ₹18,670 | ₹13,320 |

| 24% | ₹46,420 | ₹19,745 | ₹14,497 |

Negotiation Playbook

- Know Leverage: CIBIL 750+ & Stable Job = High Leverage.

- Get Multiple Offers: Apply to 3-4 lenders within 15 days.

- Leverage Relationship: “I've been banking with you for 5 years."

- Compete: “HDFC offers 12.5%. Can you beat it?"

- Fees: Negotiate processing fee caps.

Prepayment & Foreclosure

Personal loans often have penalties.

| Lender | Lock-in | Penalty |

|---|---|---|

| SBI | 6 months | 3% |

| HDFC | 12 months | 2-4% |

| ICICI | 6 months | 4-5% |

When NOT to Take a Personal Loan

Frequently Asked Questions (FAQs)

Final Verdict

A Personal Loan is a great tool for emergencies, but a bad habit for lifestyle expenses.

Fincado Research Team

Fact CheckedOur analysis is built on deep-dive research into RBI Benchmarks and lender-specific disclosures. We verify every interest rate and fee structure against real-world borrower approvals to ensure the highest level of accuracy for Indian home buyers.

Disclaimer: Interest rates and terms are subject to change by lenders. This guide is for educational purposes. Please check the loan agreement carefully before signing.