Retirement Planning Guide: Strategy & Corpus Calculation

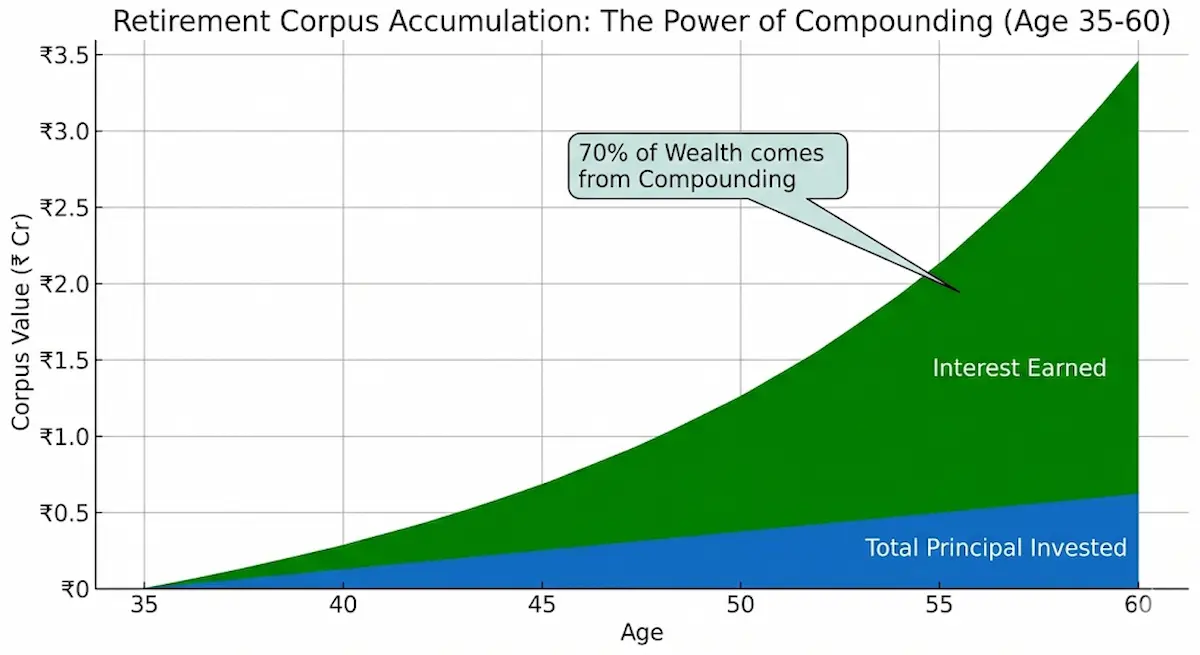

Retirement planning isn't just about saving money—it's about strategically building a corpus that can sustain your lifestyle for 25-30 years after you stop working, while inflation continuously erodes purchasing power. Most Indians severely underestimate how much they need, leading to financial stress in their golden years. This comprehensive guide provides actionable strategies, real calculations, and smart product combinations to secure your retirement.

How Much Corpus Do You Need?

The most common retirement planning mistake is guessing a random number like "₹1 crore" or "₹2 crore" without any scientific basis. Your required corpus depends on multiple personalized factors that vary dramatically from person to person.

- FV = Future value (corpus needed)

- PV = Present value (current monthly expense)

- r = Expected inflation rate

- n = Years until retirement

- • Current Age: 35

- • Retirement Age: 60

- • Life Expectancy: 85

- • Monthly Expense: ₹50,000

- • Current Savings: ₹15 Lakh

- • Inflation: 6%

₹50,000 × (1.06)^25 = ₹2,14,500 per month

To sustain ₹2.15L/month for 25 years (post-retirement):

₹5.2 Crore - ₹6 Crore

₹15 Lakh at 12% for 25 years grows to ₹2.55 Crore.

₹6 Cr (Needed) - ₹2.55 Cr (Existing) = ₹3.45 Crore Shortfall.

Why People Underestimate Needs

- Ignoring Inflation: Assuming expenses stay flat.

- Underestimating Lifespan: Living to 90 is common.

- Medical Inflation: Healthcare costs rise 10-15%.

- Lifestyle Creep: Spending rises with income.

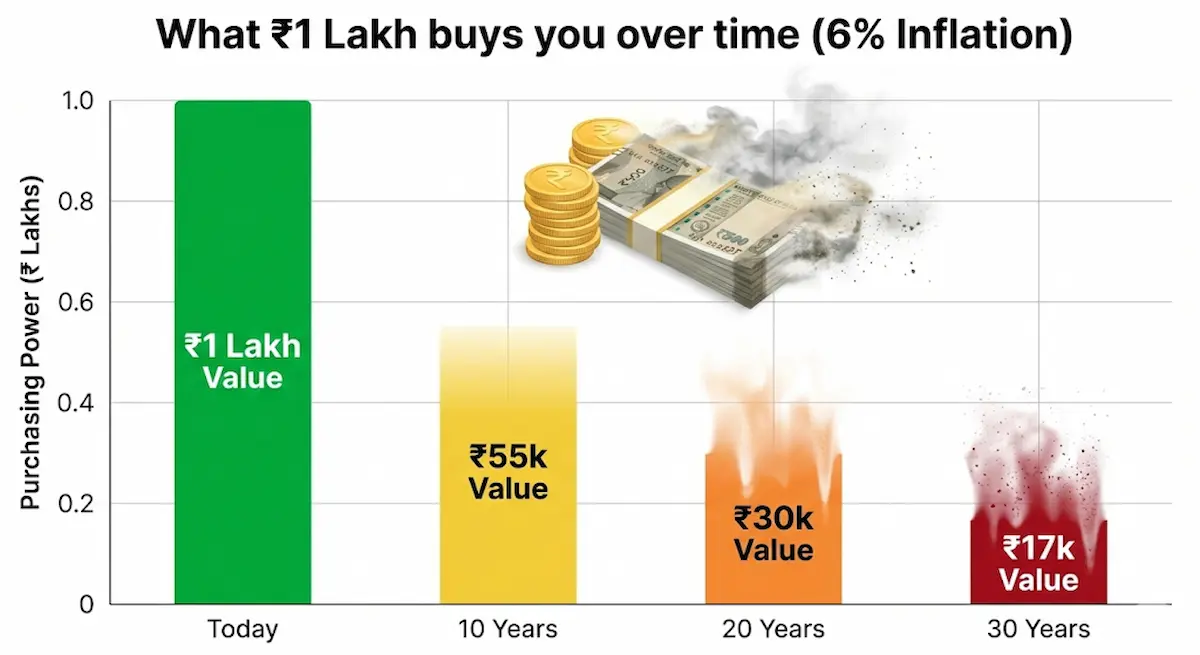

Inflation: The Silent Killer

| Current Monthly Expense | Years to Retire | Future Monthly Need (6% Inf) |

|---|---|---|

| ₹40,000 | 20 Years | ₹1.28 Lakh |

| ₹50,000 | 25 Years | ₹2.15 Lakh |

| ₹75,000 | 30 Years | ₹4.30 Lakh |

| ₹1,00,000 | 25 Years | ₹5.42 Lakh |

Healthcare costs in India inflate at 10-15% annually.

- Cardiac Surgery: ₹5 Lakh today → ₹40-50 Lakh in 25 years.

- Room Charges: ₹5k/day → ₹40k/day.

Must Have: ₹25-50L Health Insurance + Critical Illness Cover.

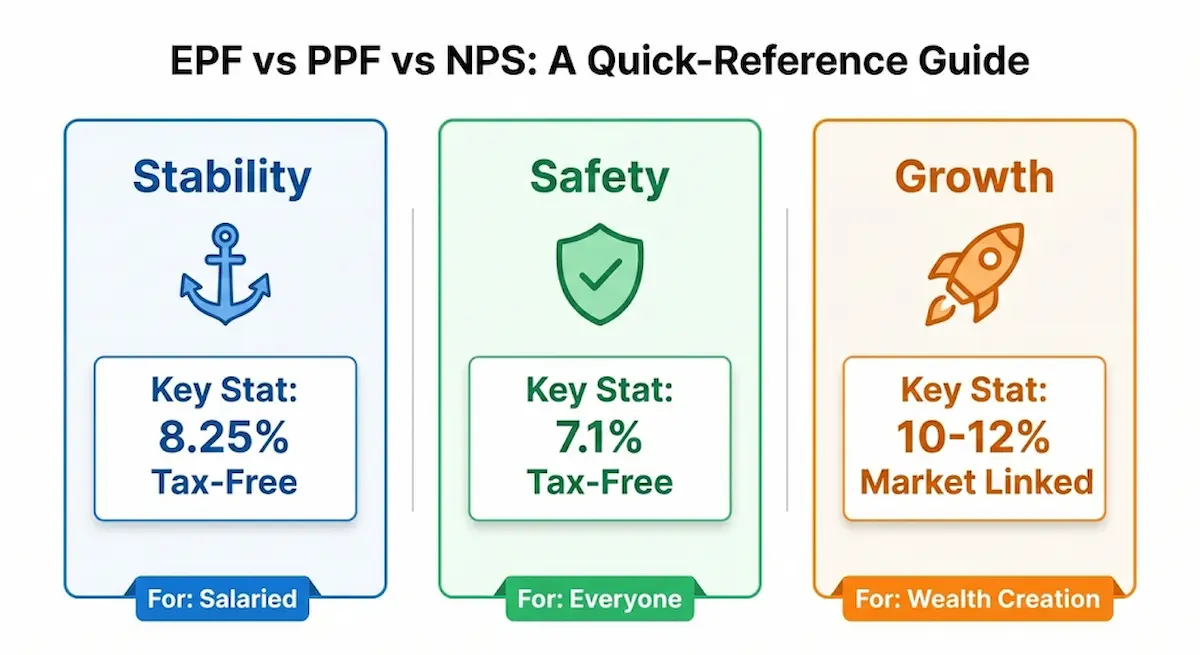

EPF + PPF + NPS: The Three Pillars

Smart planners use a combination that balances safety, growth, tax efficiency, and liquidity.

- Mandatory for Salaried.

- 8.25% Interest.

- EEE Tax Status.

- Role: Stability Anchor.

- Open to All.

- 7.1% (Govt backed).

- 15 Year Lock-in.

- Role: Safe Compounding.

- Market Linked (10-14%).

- Extra ₹50k Tax Benefit.

- Flexible Allocation.

- Role: Wealth Engine.

Optimal Allocation Strategy (Age 30-40)

| Product | Allocation | Purpose |

|---|---|---|

| EPF | Automatic (12%) | Base Stability |

| PPF | 15-20% | Tax-Free Debt |

| NPS | 30-40% | Equity Growth |

| Equity MFs | 30-40% | Max Aggressive Growth |

| Strategy (25Y Investment) | Final Corpus | Net (Post Tax) |

|---|---|---|

| EPF Only (8.25%) | ₹2.46 Cr | ₹2.46 Cr |

| PPF Only (7.1%) | ₹2.06 Cr | ₹2.06 Cr |

| NPS (12%) | ₹3.76 Cr | ₹3.20 Cr |

| Balanced Mix (10.5%) | ₹3.18 Cr | ₹2.85 Cr (Optimal) |

Calculator Guide

Online calculators are powerful if used correctly. Essential Inputs:

- 1. Inflation: Use 6-7% (General), 10% (Medical).

- 2. Life Expectancy: Plan till age 85-90.

- 3. Post-Retire Return: Conservative 6-8%.

- 4. Expenses: Include annual costs (vacations).

Result: Need ₹9.47 Cr Corpus. Monthly Invest ₹52,011.

Common Mistakes & Solutions

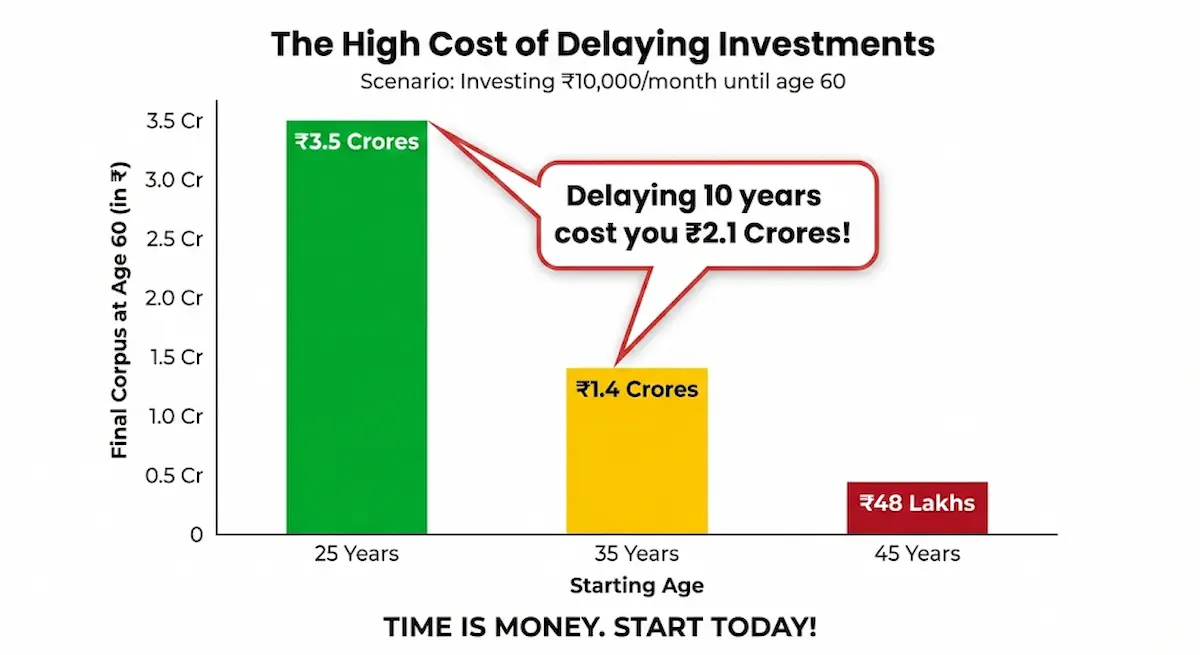

Cost: Starting at 45 instead of 25 reduces corpus from ₹3.5 Cr to ₹48 Lakh (for same SIP).

Solution: Start now, even small.

Cost: EPF (8.25%) barely beats inflation. Real return ~1-2%.

Solution: Add Equity (NPS/MFs) for growth.

Cost: Withdrawing ₹10L at age 40 kills ₹47L of future corpus (at 60).

Solution: Keep retirement funds untouchable.

Cost: 100% Debt = Low Growth. 100% Equity = Risk near retirement.

Solution: Shift from Equity to Debt as you age (Glide Path).

Cost: One surgery can wipe out savings. Medical inflation is 15%.

Solution: Separate medical corpus + Health Insurance.

Cost: Planning for 15 years post-retire, but living 30 years. Running out of money at 75.

Solution: Plan for age 90.

Cost: Expenses rise with income, but savings don't keep up.

Solution: Save 50% of every raise.

Cost: Portfolio drift risk.

Solution: Annual review and rebalancing.

Actionable Checklist

- Start EPF.

- Open PPF (₹12.5k/mo).

- Start Equity SIP (₹5-10k).

- Term & Health Insurance.

- Target: Save 20-25% of income.

- Max PPF (₹1.5L).

- Increase NPS (₹1-2L).

- Step up SIPs by 10%.

- Review Portfolio Annually.

- Target: Corpus = 3-5x Annual Income.

- Boost savings to 30-35%.

- Max all tax-saving options.

- Start reducing equity exposure.

- Clear high-interest debt.

- Target: Corpus = 8-12x Annual Income.

- Shift to 60-70% Debt.

- Plan Annuity Strategy.

- Calculate Post-Retire Income sources.

- Target: 100% of Corpus Goal.

- Set up SWP.

- Convert NPS to Annuity.

- Maintain 15-20% Equity for growth.

- Monitor withdrawal rate (4-5%).

- Update Estate Planning.

Final Thoughts

Retirement planning is your responsibility. The corpus you need might seem daunting (₹5-10 Cr), but broken down into monthly SIPs started early, it's achievable.

Fincado Research Team

Fact CheckedOur analysis is built on deep-dive research into RBI Benchmarks and lender-specific disclosures. We verify every interest rate and fee structure against real-world borrower approvals to ensure the highest level of accuracy for Indian home buyers.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Always consult your financial advisor.

Find Your Retirement Number

Use our free retirement calculator to see exactly how much you need to save monthly.