How much SIP is needed for ₹1 Crore in 10 Years?

Building a corpus of ₹1 Crore is the definitive financial milestone for millions of Indian investors. Achieving this in 10 years is an aggressive goal that requires discipline, the right asset allocation, and a substantial monthly investment.

To reach ₹1 Crore in 10 Years, assuming a 12% annual return from equity mutual funds, you need to start a monthly SIP of roughly ₹43,041.

*Tweaking these numbers helps you find a comfortable monthly goal.

The Math: How ₹43k Becomes ₹1 Crore

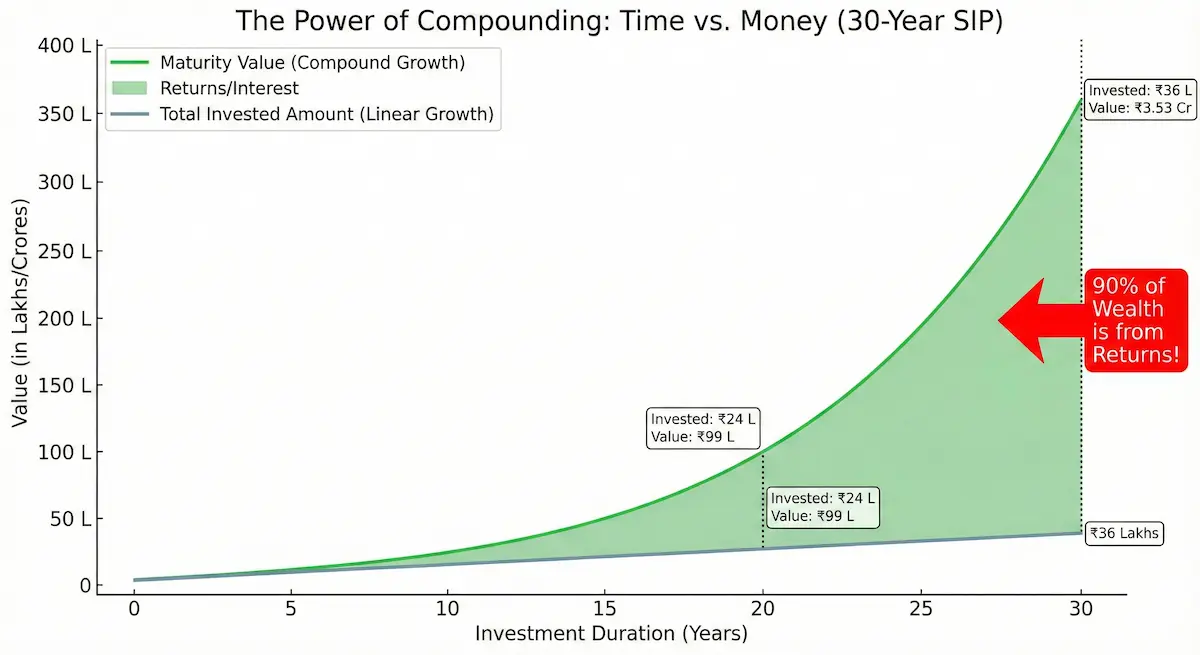

When you invest for 10 years, you rely heavily on your principal contribution because the compounding effect explodes after the 10th year.

| Parameter | Value |

|---|---|

| Target Amount | ₹1,00,00,000 (1 Crore) |

| Time Period | 10 Years (120 Months) |

| Expected Return | 12% (Equity Benchmark) |

| Monthly SIP | ₹43,041 |

| Total Invested | ₹51.6 Lakhs |

| Wealth Gained | ₹48.4 Lakhs |

Is ₹43k Too High? The Cost of Delay

| Time | SIP Needed | Total Invested | Ease |

|---|---|---|---|

| 10 Years | ₹43,041 | ₹51.6 L | Hard |

| 15 Years | ₹19,819 | ₹35.6 L | Moderate |

| 20 Years | ₹10,009 | ₹24.0 L | Easy |

| 25 Years | ₹5,270 | ₹15.8 L | Very Easy |

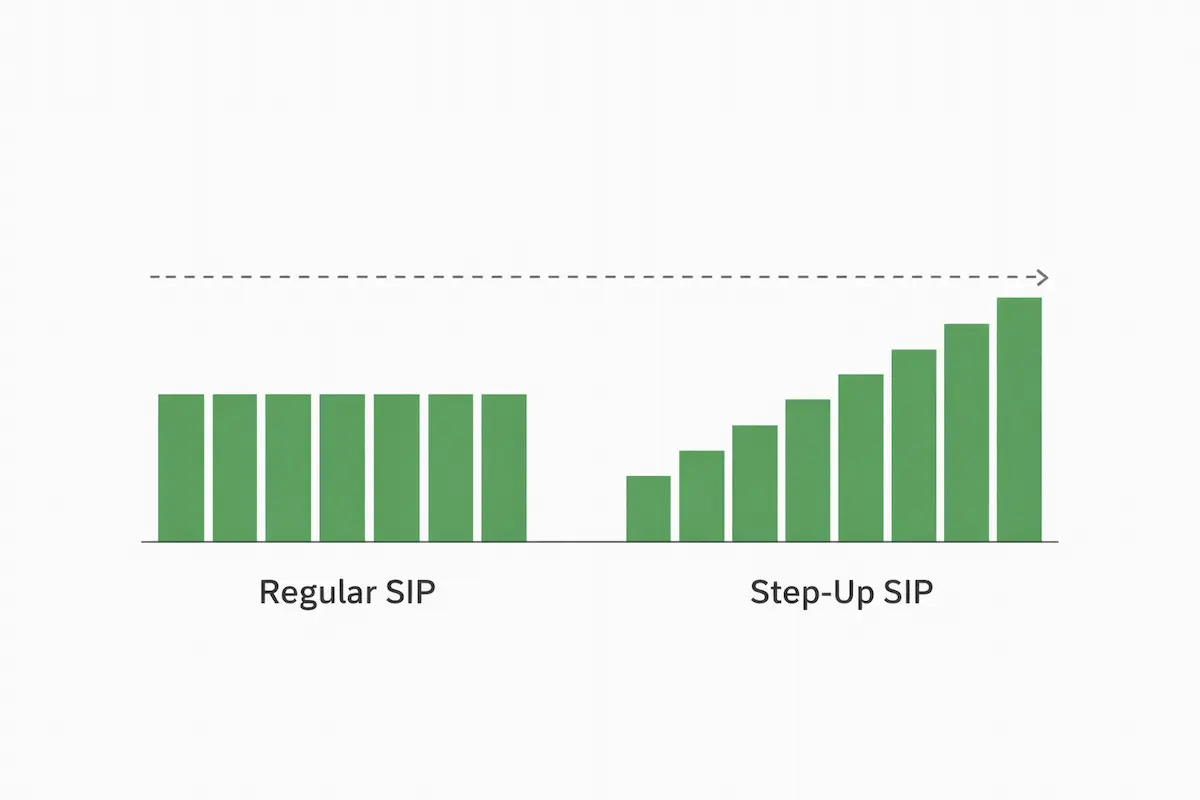

The "Step-Up“ Strategy

Can't start with ₹43k? Start small and increase your SIP by 15% every year.

- Starting SIP:₹25,000 / month

- Annual Increase:15%

- Result (10 Yrs):₹1.03 Crore ✅

| Year | Monthly SIP | Corpus (Year End) |

|---|---|---|

| Year 1 | ₹25,000 | ₹3.2 L |

| Year 5 | ₹43,725 | ₹28.4 L |

| Year 10 | ₹87,900 | ₹1.03 Cr |

Where Should You Invest?

Aim: 14-15% Return

- 40% Mid Cap

- 30% Small Cap

- 30% Flexi Cap

High volatility risk.

Aim: 12% Return

- 50% Nifty 50 Index

- 30% Flexi Cap

- 20% Mid Cap

Stable long-term growth.

Mistakes That Kill the Dream

Pausing during market dips kills your accumulation phase.

₹1 Cr in 10 years = ₹55L today. Aim higher if possible.

Buying 10 funds dilutes returns. Stick to 3.

Frequently Asked Questions

Conclusion

Reaching ₹1 Crore in 10 years is possible. It requires a SIP of ₹43,000 (or ₹25,000 with step-ups). The most important factor is not the amount, but the start date.

Fincado Research Team

Fact CheckedOur analysis is built on deep-dive research into RBI Benchmarks and lender-specific disclosures. We verify every interest rate and fee structure against real-world borrower approvals to ensure the highest level of accuracy for Indian home buyers.

Calculate Your Own Path

Want to see how much YOU need to save based on your current age? Use our free calculator.