SIP Investment Guide 2025-26: Strategy & Tax Rules

SIP (Systematic Investment Plan) is a disciplined investment method where you invest a fixed amount regularly (monthly, quarterly, or weekly) in mutual funds, regardless of market conditions. It's the Indian retail investor's most powerful wealth-creation tool, with over 7.8 crore active SIP accounts as of December 2025, contributing ₹19,000+ crore monthly to mutual funds.

SIP vs Traditional Investing

| Feature | SIP | Lump Sum | RD (Recurring Deposit) |

|---|---|---|---|

| Investment Pattern | Fixed amount regularly | One-time large amount | Fixed amount regularly |

| Returns | 12-15% (Equity) | Variable (Timing dependent) | 5.5-7.5% (Guaranteed) |

| Market Risk | Averaged (Rupee Cost Averaging) | High (Timing Risk) | Zero |

| Liquidity | High (Redeem anytime) | High | Penalty on premature withdrawal |

| Lock-in | None (Except ELSS) | None | Usually 5 years |

- Minimum Investment: As low as ₹500/month.

- Flexibility: Increase, pause, or stop anytime.

- Automation: Auto-debit ensures discipline.

- Rupee-Cost Averaging: Buy more units when low, fewer when high.

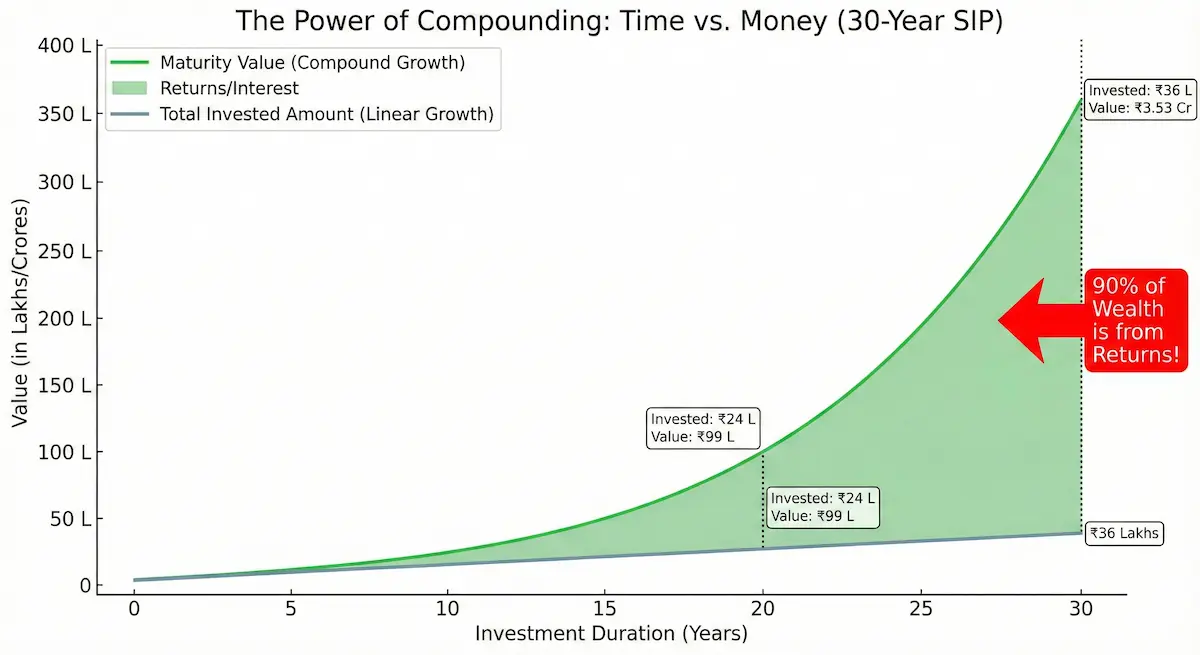

How SIP Works: Compounding Magic

| Period | Total Invested | Maturity Value | Wealth Gain | Multiple |

|---|---|---|---|---|

| 5 Years | ₹6,00,000 | ₹8,16,000 | ₹2,16,000 | 1.36x |

| 10 Years | ₹12,00,000 | ₹23,00,000 | ₹11,00,000 | 1.92x |

| 15 Years | ₹18,00,000 | ₹50,00,000 | ₹32,00,000 | 2.78x |

| 20 Years | ₹24,00,000 | ₹99,00,000 | ₹75,00,000 | 4.13x |

| 25 Years | ₹30,00,000 | ₹1,89,00,000 | ₹1,59,00,000 | 6.30x |

| 30 Years | ₹36,00,000 | ₹3,53,00,000 | ₹3,17,00,000 | 9.81x |

SIP vs Lump Sum: The Verdict

The eternal debate: Should you invest ₹12 lakh at once or ₹1 lakh monthly for 12 months?

| Market Scenario | SIP Return | Lump Sum Return | Winner |

|---|---|---|---|

| Bull Market (Steady Rise) | 38-45% | 52-68% | Lump Sum |

| Bear Market (Crash) | 12-15% | -10 to +5% | SIP (Big Win) |

| Volatile Market (Up & Down) | 14-17% | 11-13% | SIP |

| 25-Year Average | 12.8% | 11.9% | SIP (Slight Edge) |

- Market is volatile or bearish.

- You are a beginner.

- You have regular income (salary).

- You want to avoid timing risk.

- You are risk-averse.

- Market is at a correction bottom (-20%).

- Sustained bull run follows.

- You have a windfall (bonus/inheritance).

- Long horizon (10+ yrs) to recover.

Best SIP Amount by Age

Income Profile: ₹20,000 - ₹40,000/month

| Monthly Income | Recommended SIP | Goal |

|---|---|---|

| ₹25,000 | ₹2,500 - ₹5,000 (10-20%) | Build habit |

| ₹35,000 | ₹5,000 - ₹7,000 | ₹10L corpus by 30 |

Allocation: 90% Equity (Small/Mid Cap), 10% Debt.

Income Profile: ₹40,000 - ₹1,00,000/month

| Monthly Income | Recommended SIP | Goal |

|---|---|---|

| ₹50,000 | ₹10,000 - ₹15,000 (20-30%) | House down payment |

| ₹1,00,000+ | ₹25,000 - ₹40,000 | Financial Independence |

Allocation: 80% Equity (Flexi Cap), 15% Debt, 5% Gold.

Income Profile: ₹1L - ₹3L/month

| Monthly Income | Recommended SIP | Goal |

|---|---|---|

| ₹1,50,000 | ₹50,000 - ₹75,000 (33-50%) | ₹2 Crore Corpus |

| ₹3,00,000+ | ₹1.2L - ₹1.8L | Retirement |

Allocation: 70% Equity (Large/Index), 25% Debt, 5% Gold.

SIP Returns Matrix (12%)

Real-world projections for different SIP amounts. Note how ₹5k can turn into ₹1.7 Crore over 30 years.

₹5,000 Monthly SIP

| Years | Invested | Maturity | Gain |

|---|---|---|---|

| 10 | ₹6 L | ₹11.5 L | ₹5.5 L |

| 20 | ₹12 L | ₹49.5 L | ₹37.5 L |

| 30 | ₹18 L | ₹1.76 Cr | ₹1.58 Cr |

₹10,000 Monthly SIP

| Years | Invested | Maturity | Gain |

|---|---|---|---|

| 10 | ₹12 L | ₹23 L | ₹11 L |

| 20 | ₹24 L | ₹99 L | ₹75 L |

| 30 | ₹36 L | ₹3.53 Cr | ₹3.17 Cr |

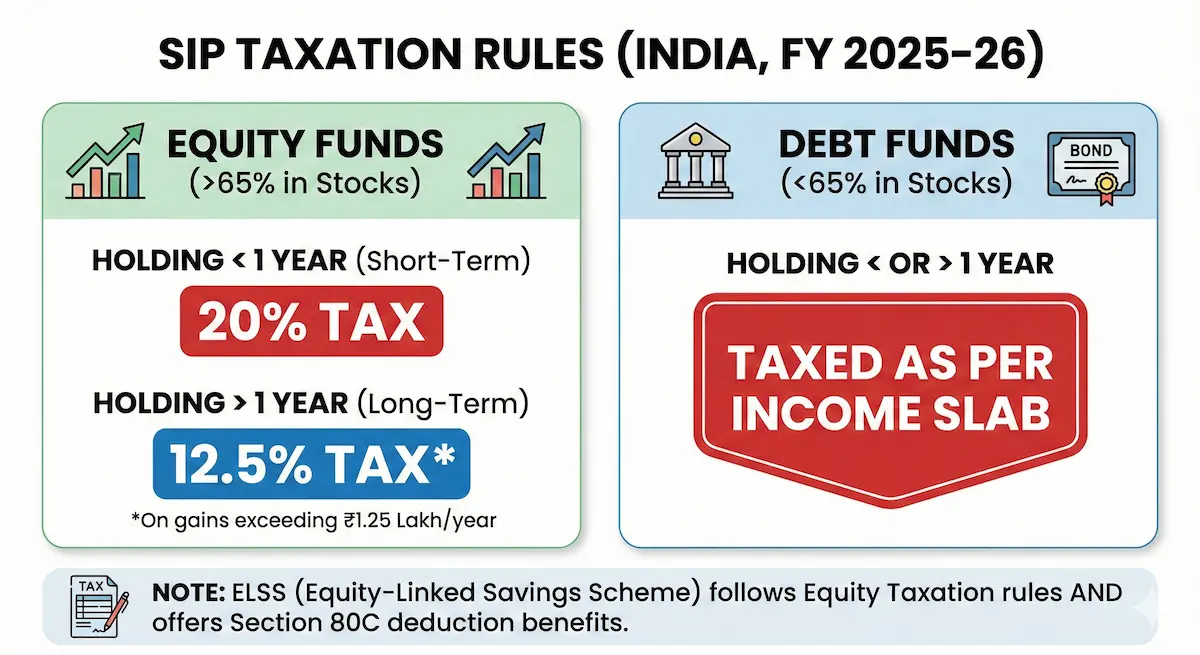

SIP Tax Rules (2025)

- STCG (<12 mo): 20% on gains.

- LTCG (>12 mo): 12.5% on gains above ₹1.25 Lakh/year.

Taxed at your Income Tax Slab Rate. No LTCG/STCG distinction benefits (from April 2023).

FIFO Method: Each SIP installment is treated separately. First units bought are first ones sold for tax calculation.

ELSS: Offers 80C deduction up to ₹1.5L. 3-year lock-in per installment. Same equity taxation applies on exit.

SIP During Market Crash

| Strategy during 2008 Crash | Units Accumulated | Value (Jan 2014) |

|---|---|---|

| Paused SIP (Panic) | 615 units | ₹12.92 Lakh |

| Continued SIP | 895 units | ₹18.80 Lakh |

| Doubled SIP | 1,240 units | ₹26.04 Lakh (2.6x more!) |

- NEVER Stop SIP: Crashes last 6-18 months. Missing this means missing the best buying prices.

- Top-Up if Possible: If market falls 20%, deploy spare cash to buy more units.

- Don‘t Time Bottom: Nobody knows the bottom. Just keep buying.

Minimum Duration Rule

Equity needs time to stabilize volatility. Follow these minimum holding periods:

| Fund Type | Min Duration | Reason |

|---|---|---|

| Large Cap / Index | 5-7 Years | Lower volatility, stable returns |

| Mid Cap | 7-10 Years | High volatility, needs time |

| Small Cap | 10-15 Years | Extreme moves, massive long-term gains |

| Debt Funds | 3-5 Years | For medium-term goals |

Common SIP Mistakes

Pays tax immediately, kills compounding. Always choose Growth.

Misses the best accumulation phase. Big loss.

Buying 15 funds dilutes returns. Stick to 3-5.

Inflation eats static SIPs. Step-up 10% annually.

Waiting for bottom usually means missing the rally.

Redeeming for small expenses like phones kills wealth.

SIP Myths Debunked

Frequently Asked Questions (FAQs)

Final Verdict

SIP is India‘s most accessible wealth-creation tool. The magic lies in consistency.

Fincado Research Team

Fact CheckedOur analysis is built on deep-dive research into RBI Benchmarks and lender-specific disclosures. We verify every interest rate and fee structure against real-world borrower approvals to ensure the highest level of accuracy for Indian home buyers.

Disclaimer: Mutual Fund investments are subject to market risks. Read all scheme related documents carefully. Past performance is not an indicator of future returns. This guide is for educational purposes only.