Sukanya Samriddhi Yojana 2026: Rules, Interest & Benefits

Choosing the best investment for your girl child is one of the most important financial decisions Indian parents face. With options like Sukanya Samriddhi Yojana (SSY) offering 8.2% guaranteed returns and Mutual Funds delivering 12-14% growth, the choice requires careful planning.

This guide compares SSY vs PPF vs Mutual Funds head-to-head, analyzes the 21-year lock-in, and reveals the strategic "60-40 Rule" to secure your daughter's education and marriage goals.

What is Sukanya Samriddhi Yojana?

Sukanya Samriddhi Yojana (SSY) is a government-backed savings scheme launched as part of the *Beti Bachao, Beti Padhao* campaign. It is designed to build a corpus for a girl child's education and marriage expenses. It currently offers the highest interest rate among all small savings schemes in India.

Eligibility & Account Rules

- •Girl Child: Must be below 10 years of age at the time of account opening.

- •Guardian: A parent or legal guardian can open and operate the account until the girl turns 18.

- •Limit: Maximum 2 accounts per family (one for each girl child). Exception: 3 accounts allowed in case of twins/triplets.

Deposit Limits & Rules

₹250

Per financial year. A penalty of ₹50 is levied if the minimum deposit is missed.

₹1.5 Lakh

Per financial year. Amount qualifies for deduction under Section 80C.

Interest Rate (8.2%)

| Period | Interest Rate |

|---|---|

| Q4 FY 2024-25 (Jan-Mar) | 8.2% |

| Q3 FY 2024-25 (Oct-Dec) | 8.2% |

| FY 2023-24 | 8.0% |

Withdrawal Rules

- 1Partial Withdrawal (Education): Allowed only after the girl child turns 18 or passes 10th standard. Maximum 50% of the balance at the end of the preceding financial year.

- 2Premature Closure (Marriage): Allowed after the girl turns 18 for marriage expenses. Proof of marriage is required.

- 3Maturity: The account matures 21 years from the date of opening. The full amount (Principal + Interest) is paid tax-free.

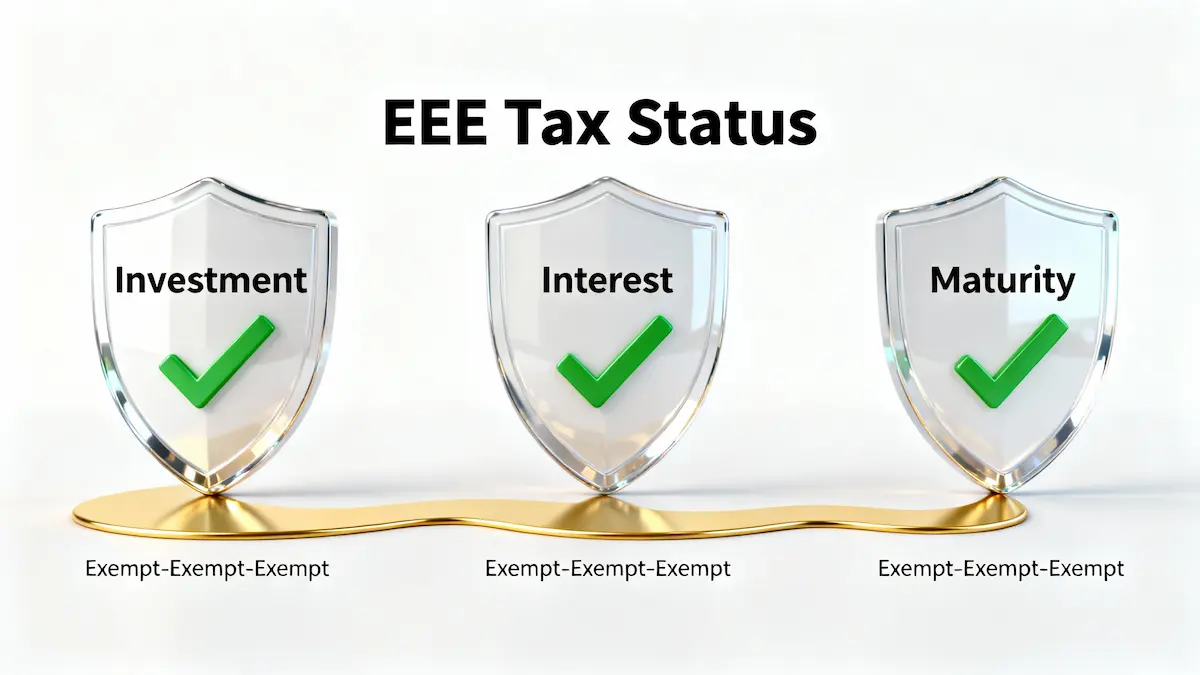

Tax Benefits: EEE Status

SSY falls under the EEE (Exempt-Exempt-Exempt) category, making it one of the most tax-efficient investment vehicles in India.

- Investment:Section 80C Deduction (up to ₹1.5L)

- Interest Earned:100% Tax-Free

- Maturity Amount:100% Tax-Free

Comparison: SSY vs PPF vs Mutual Funds

| Feature | SSY | PPF | Mutual Funds |

|---|---|---|---|

| Interest/Return | 8.2% (Fixed) | 7.1% (Fixed) | 12-14% (Variable) |

| Risk | Zero (Govt) | Zero (Govt) | Medium-High |

| Lock-In | 21 Years | 15 Years | Liquid (No Lock-in) |

| Tax Benefit | EEE (Free) | EEE (Free) | LTCG (12.5% > 1.25L) |

The "60-40 Rule" Strategy

Don't choose just one. Allocate 60% to SSY for safety (Education base) and 40% to Equity SIPs for growth (Marriage/Higher Studies).

Invest ₹1.5L/yr → SSY Corpus: ~₹70 Lakhs (Safe)

Invest ₹1L/yr → MF Corpus: ~₹90 Lakhs (Growth @ 12%)

Maturity Corpus Examples (SSY @ 8.2%)

| Annual Deposit | Total Invested (15 Yrs) | Maturity Amount (21 Yrs) |

|---|---|---|

| ₹50,000 | ₹7.5 Lakhs | ~₹23 Lakhs |

| ₹1,00,000 | ₹15 Lakhs | ~₹46 Lakhs |

| ₹1,50,000 | ₹22.5 Lakhs | ~₹69 Lakhs |

Frequently Asked Questions (FAQs)

Final Verdict

If you have a daughter below 10 years, SSY should be your first choice for the safety component of her portfolio. It offers the highest government-backed interest rate and zero risk.

Fincado Research Team

Fact CheckedOur analysis is built on deep-dive research into RBI Benchmarks and lender-specific disclosures. We verify every interest rate and fee structure against real-world borrower approvals to ensure the highest level of accuracy for Indian home buyers.

Disclaimer: Interest rates and rules are subject to change by the Government of India. This guide is for educational purposes. Please consult a financial advisor for personalized planning.

Plan for her future today

Calculate how much corpus you can build with SSY and SIPs.