Tax on ₹10 Lakh Salary: New vs Old Regime Breakdown (FY 2025-26)

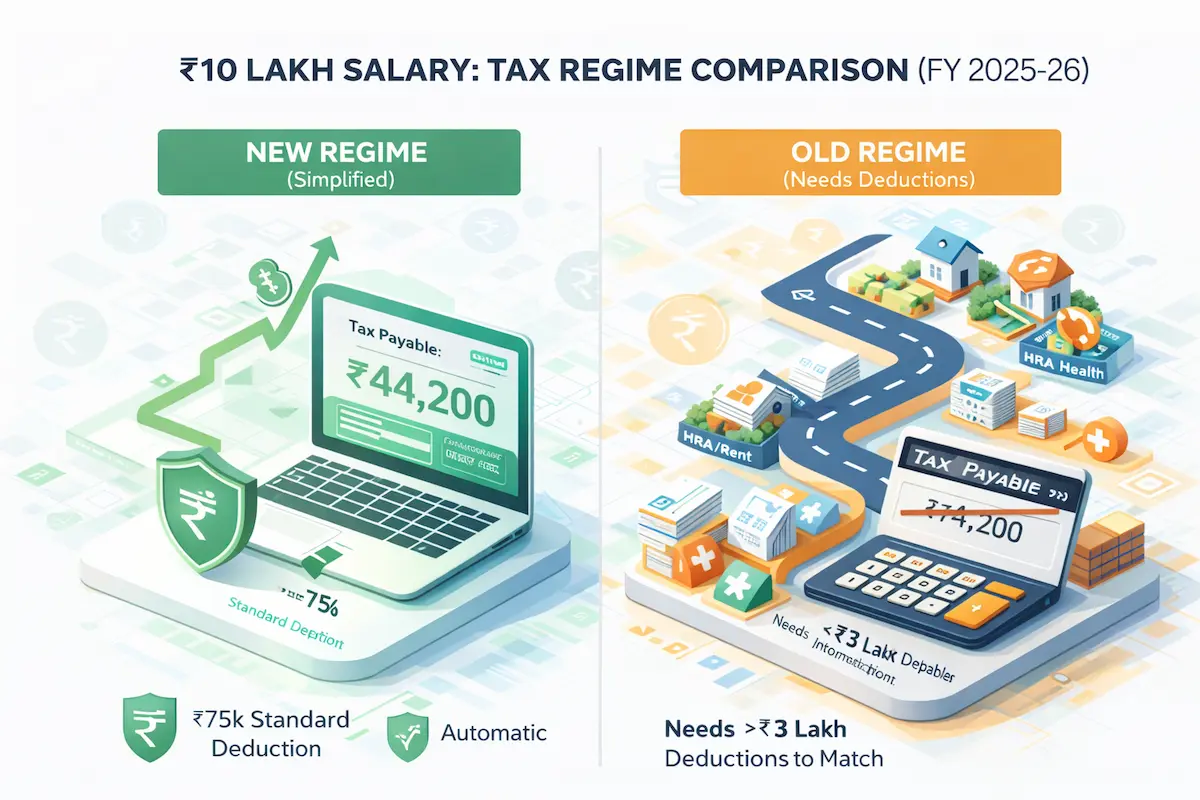

Earning ₹10 Lakhs (10 LPA) is a significant milestone, but it also pushes you into higher tax slabs. For FY 2025-26, the tax difference between the New and Old regimes is massive—almost ₹60,000! Choosing the wrong regime could cost you a month's salary.

₹44,200

(Default option, minimal paperwork)

₹1,06,600

(Without investments)

Check Your Specific Case:

Includes 80C, 80D, HRA, Home Loan Interest etc.

New Regime saves you ₹62,400 🎉

Monthly In-Hand Breakdown

| Component | New Regime | Old Regime |

|---|---|---|

| Gross Salary | ₹83,333 | ₹83,333 |

| Less: PF (Est.) | - ₹5,000 | - ₹5,000 |

| Less: Prof Tax | - ₹200 | - ₹200 |

| Less: TDS (Income Tax) | - ₹3,683 | - ₹8,883 |

| In-Hand Salary | ₹74,450 | ₹69,250 |

*PF assumed at 12% of Basic (Basic = 50% of Gross). TDS is averaged monthly.

Where Does Your ₹10L Go?

Annual Take-home.

New Regime Tax.

PF + PT Savings.

New Regime Calculation

| Slab (New) | Rate | Calculation |

|---|---|---|

| 0 - 3L | Nil | ₹0 |

| 3L - 7L | 5% | ₹20,000 |

| 7L - 9.25L | 10% | ₹22,500 |

| Total Tax | - | ₹42,500 |

| Total + Cess (4%) | - | ₹44,200 |

Old Regime Calculation

| Slab (Old) | Rate | Calculation |

|---|---|---|

| 0 - 2.5L | Nil | ₹0 |

| 2.5L - 5L | 5% | ₹12,500 |

| 5L - 9.5L | 20% | ₹90,000 |

| Total Tax | - | ₹1,02,500 |

| Total + Cess (4%) | - | ₹1,06,600 |

The Break-Even Point: ₹3.75 Lakhs

To pay less tax in the Old Regime than the New Regime, your total deductions (80C, HRA, etc.) must exceed ₹3,75,000.

Fincado Research Team

Fact CheckedOur analysis is built on deep-dive research into RBI Benchmarks and lender-specific disclosures. We verify every interest rate and fee structure against real-world borrower approvals to ensure the highest level of accuracy for Indian home buyers.