Tax on ₹12 Lakh Salary (2025): New vs Old Regime + In-Hand Pay

Earning a ₹12 Lakh salary places you in India's growing upper-middle class, but it also increases your tax liability. For FY 2025-26, the choice between the New vs Old Tax Regime is critical. Making the wrong decision could cost you over ₹90,000 in unnecessary taxes.

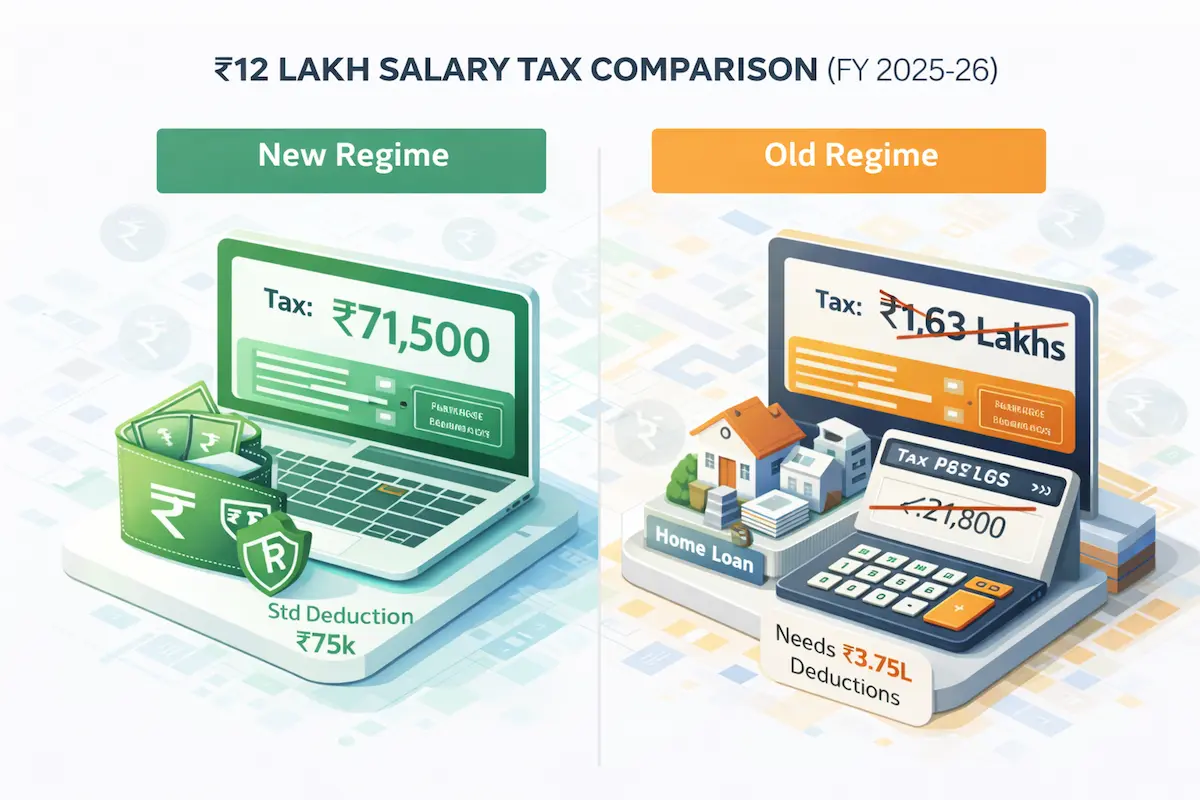

For a ₹12 Lakh salary, the New Tax Regime is the clear winner for most people. Your total tax will be approx ₹71,500.

If you earn ₹12 lakh per year in India, your take-home salary is roughly ₹87,800 per month under the New Tax Regime.

| Annual Salary | ₹12,00,000 |

| Tax (New Regime) | ₹71,500 |

| Monthly In-Hand | ₹87,842 |

| Best Regime | New |

Check Your Specific Case:

Includes 80C, 80D, HRA, Home Loan Interest etc.

New Regime saves you ₹92,300 🎉

Monthly In-Hand Breakdown

| Component | Monthly (New Regime) | Monthly (Old Regime) |

|---|---|---|

| Gross Salary | ₹1,00,000 | ₹1,00,000 |

| Less: PF (Est.) | - ₹6,000 | - ₹6,000 |

| Less: Prof Tax | - ₹200 | - ₹200 |

| Less: TDS | - ₹5,958 | - ₹13,650 |

| In-Hand Salary | ₹87,842 | ₹80,150 |

*Old Regime calculation assumes NO other deductions except standard deduction.

Where Does Your ₹12L Go?

Disposable income.

New Regime Tax.

Long-term savings.

New Regime Calculation

Taxable Income: ₹12,00,000 - ₹75,000 = ₹11,25,000.

| Slab | Rate | Tax |

|---|---|---|

| 0 - 3L | Nil | 0 |

| 3L - 7L | 5% | ₹20,000 |

| 7L - 10L | 10% | ₹30,000 |

| 10L - 11.25L | 15% | ₹18,750 |

| Total + Cess(4%) | - | ₹71,500 |

New vs Old Regime

| Feature | New Regime | Old Regime (No Ded.) |

|---|---|---|

| Tax Payable | ₹71,500 | ₹1,63,800 |

| Savings | New Regime saves you ₹92,300 | |

The Break-Even Point

To make the Old Regime worth it, you need to reduce your taxable income massively.

₹3,75,000

If your total deductions (80C, HRA, etc.) exceed this amount, switch to Old Regime. Otherwise, stick to New Regime.

Who Should Choose What?

Maxes out 80C but pays no rent.

- Rent: ₹0

- 80C: ₹1.5L

- NPS: ₹50k

Pays rent + has Home Loan + 80C.

- Home Loan Int: ₹2L

- 80C: ₹1.5L

- 80D: ₹25k

Conclusion

For a ₹12 Lakh salary, the New Tax Regime is efficient and stress-free. It leaves you with ~₹88,000 monthly in hand. Unless you have a Home Loan AND maximize Section 80C, sticking to the New Regime is the smartest financial move.

Fincado Research Team

Fact CheckedOur analysis is built on deep-dive research into RBI Benchmarks and lender-specific disclosures. We verify every interest rate and fee structure against real-world borrower approvals to ensure the highest level of accuracy for Indian home buyers.

Calculations are based on income tax slabs for FY 2025-26 applicable to resident individuals below 60 years.